Founded in 2020 with an aim to streamline B2B procurement, Zip expanded its offerings by introducing intake-to-pay and AP automation in 2023.

Zip initially filled the gap that Coupa users experienced, such as a lack of no-code intake workflows and direct spend management. However, while Zip tries to differentiate itself, it has encountered a raft of other competitors, some of them with more mature solutions. In this blog post, we will take a closer look at the top 7 Zip alternatives to help you make an informed decision.

Comparison criteria.

When evaluating Zip alternatives, it’s important to focus on key criteria, such as,

- The range and depth of features the platform offers.

- User experience.

- Pricing structure.

- Reviews and ratings.

Overview: Zip alternatives and competitors.

| Competitor | Top Feature | Primary Market | G2 Rating | Pricing |

| Airbase | P2P | Mid-market | 4.8 | $$ |

| Oracle NetSuite | ERP | Mid-market | 4.7 | $$$ |

| Sage Intacct | ERP | Mid-market | 4.3 | $$$ |

| Navan | Expenses | Enterprise | 4.7 | $$$ |

| Teampay | Expenses | Mid-market | 4.4 | $$ |

| Mesh Payments | Expenses | Enterprise | 4.6 | $$$ |

| Coupa | P2P | Enterprise | 4.2 | $$$$ |

1. Airbase.

As one of the leading Zip competitors, Airbase empowers accounting and finance professionals with tailored offerings across AP automation, corporate cards, guided procurement, and expense management. These modules are all governed by Airbase’s intake function called Guided Procurement.

Automated intake process with customizable approval flows

In contrast, Zip primarily focuses on the procurement function as an intake workflow software with nascent payment and virtual card features. Airbase has extensive spend analytics that provides data and insights on spending, vendors, and the efficiency of the procurement cycle itself.

Best features.

End-to-end platform: A comprehensive procure, pay, close solution that combines the power of procurement intake, AP automation, expense management, and corporate cards.

- In-depth AP automation capabilities: Expedites month-end closing with seamless bill creation, 3-way PO matching, auto-categorization of expenses, and deep integration with GL.

- Spend Analytics: Provides data, reporting, and insights on all non-payroll spend for better decision-making and process improvements.

- Simplified vendor management: Facilitates collaboration and compliance with a centralized vendor management portal and intelligent workflows.

- Robust payment capabilities: Streamlines payments with direct payments, international payment support, and the ability to link multiple banks to a subsidiary.

- Deep integrations: Offers native and custom integrations with major GLs, ERPs, HRIS, and common business apps used by stakeholders like Slack, JIRA, and DocuSign.

- AI-powered expense management: Enhances spend management efficiency with pre-approved corporate cards, OCR receipt scanning, gen-AI expense report creation, custom approval workflows, and travel booking integration.

- 24/7 fraud and risk mitigation: Flags potential fraud with a dedicated fraud investigation team that operates around the clock.

Airbase G2 rating: 4.8/5

Airbase pricing.

Airbase offers three packages: Standard, Premium, and Enterprise. All the packages include key platform features while optional add-ons are available for travel, POs, and approval workflows. Users can also opt for individual modules instead of the whole platform.

Customers and best suited for:

- Company size: Mid-market to large enterprises (with 50 to 10,000 employees).

- Solution needs: Businesses looking for a total procurement solution. It can be used to address all aspects of spend: Guided Procurement (also known as procurement intake), Account Payable Automation, Expense Management, and Corporate Cards, or as an all-in-one procure, pay, close solution by adopting the full suite.

2. Oracle NetSuite.

Oracle NetSuite is one of the viable alternatives to Zip given the wide range of financial solutions it offers. Unlike Zip, which has basic procurement features, the ERP software has advanced capabilities across AP automation, inventory management, expense tracking, and analytics.

Dashboard with procurement insights

Best features.

- Centralized billing: Keeps track of bills across projects, vendors, and partners while extracting data from invoices submitted by vendors.

- Automated approval workflows: Supports manual creation of expense reports and routes them through defined approval workflows.

- Multi-subsidiary support: Facilitates the creation of different accounting periods and reconciliation of transactions across multiple subsidiaries.

- Simplified amortization: Allocates expenses across a specified timeframe and recognition of expenses in increments.

- Granular financial reporting: Offers pre-built and custom financial reports with multi-dimensional analytics.

NetSuite G2 rating: 4.7/5

NetSuite pricing.

While NetSuite charges an annual license fee based on the number of users, optional modules, and the core platform, users also need to pay the initial implementation fee. Users have the option to add additional modules as they scale.

Customers and best suited for:

- Company size: Rapidly growing small companies, mid-market, and enterprise businesses across industries.

- Solution needs: Businesses in need of a powerful ERP solution that includes accounting, order management, HR, revenue forecasting, commerce, and business planning.

3. Sage Intacct.

Next up in the list of Zip HQ competitors is Sage Intacct, a financial management solution that targets businesses with complex accounting needs.

Multi-dimensional reporting, project accounting, and deeper AP automation are some of the features that set Sage Intacct apart from Zip.

Purchase requisition with built-in compliance

Best features.

- Compliant procurement: Allows users to build custom approval workflows while tracking purchase requests, budgets, and invoices.

- AI-powered AP automation: Extracts details from an invoice and reconciles it with auto-matched transactions while flagging duplicate invoices.

- Integrated payment capabilities: Automates invoice payments thanks to integration with CSI Vendor Payments and offers real-time visibility into payment status.

- Streamlined expense management: Tracks time spent on clients and projects while enabling the creation of expense reports that are automatically routed to managers for approval.

- Simplified spend control: Enables setting of spending limits and custom validation rules for approvals in addition to offering a real-time dashboard to keep track of purchases.

Intacct G2 rating: 4.3/5

Intacct pricing.

Sage Intacct offers different stand-alone modules and the pricing is based on the number of modules that users opt for. Sage 50, the accounting software for small businesses, is priced at $58.92/month while users need to contact Sage Intacct sales for the pricing point of Sage 100, the accounting software for medium-sized businesses.

Customers and best suited for:

- Company size: Small and mid-market companies as well as accountants and bookkeepers.

- Solution needs: Businesses looking to invest in a cloud-based accounting software with add-on modules for payroll, business process management, retail operating systems, and inventory management.

4. Navan.

When comparing Zip vs Navan, it’s important to note that Navan is focused on travel and expense management while Zip, being an intake software, lacks these features.

Customizable spend policy and controls

Best features.

- Automated expense reports: Syncs the details automatically once employees add a corporate card or upload receipts.

- Customizable spend controls: Allows setting of spend controls and flags out-of-policy spends.

- Quick reconciliation and reimbursements: Categorizes and reconciles transactions and facilitates reimbursement in multiple currencies.

- Intelligent travel booking solution: Supports the creation of travel spend policies and simplifies booking of individual and group travel in addition to offering consulting services for travel management.

- Rich travel data insights: Offers real-time visibility into travel bookings and expenses on a customizable dashboard.

Navan G2 rating: 4.7/5

Navan pricing.

Navan does not charge a platform fee and users can set up an account for free.

Customers and best suited for:

- Company size: Small to medium-sized businesses and enterprises.

- Solution needs: Corporates seeking a comprehensive travel booking solution in addition to simplified expense management.

5. Teampay.

Teampay is one of the Zip alternatives to consider if you are looking for simplified intake and spend management features. A deep Slack integration allows employees to make compliant purchase requests right within the communication app.

Slack integration simplifies purchase requests

Best features.

- Real-time visibility over spend: Makes it easy to set and modify purchase policy while offering full visibility into spend with pre-approved physical and virtual cards.

- Guided purchase: Enforces compliance with the purchase policy by integrating with popular communication tools and routes requests to approvers.

- A clear audit trail: Captures transaction data and syncs with the general ledger.

- Invoice scanning: Uses OCR technology to scan invoices and matches them with POs.

- Useful integrations: Integrates with Slack to enable functions, such as PO creation and spend report requests.

Teampay G2 rating: 4.4/5

Teampay pricing.

Teampay’s website does not list the packages or pricing information.

Customers and best suited for:

- Company size: Small to mid-market businesses and enterprises.

- Solution needs: Companies looking for a simple accounting automation and expense management solution that integrates with Slack.

6. Mesh Payments.

Mesh Payments is the only software in this list of Zip alternatives that offers a dedicated solution for managing SaaS subscriptions. However, unlike Zip, Mesh Payments has no offerings related to procurement, AP automation, and vendor management.

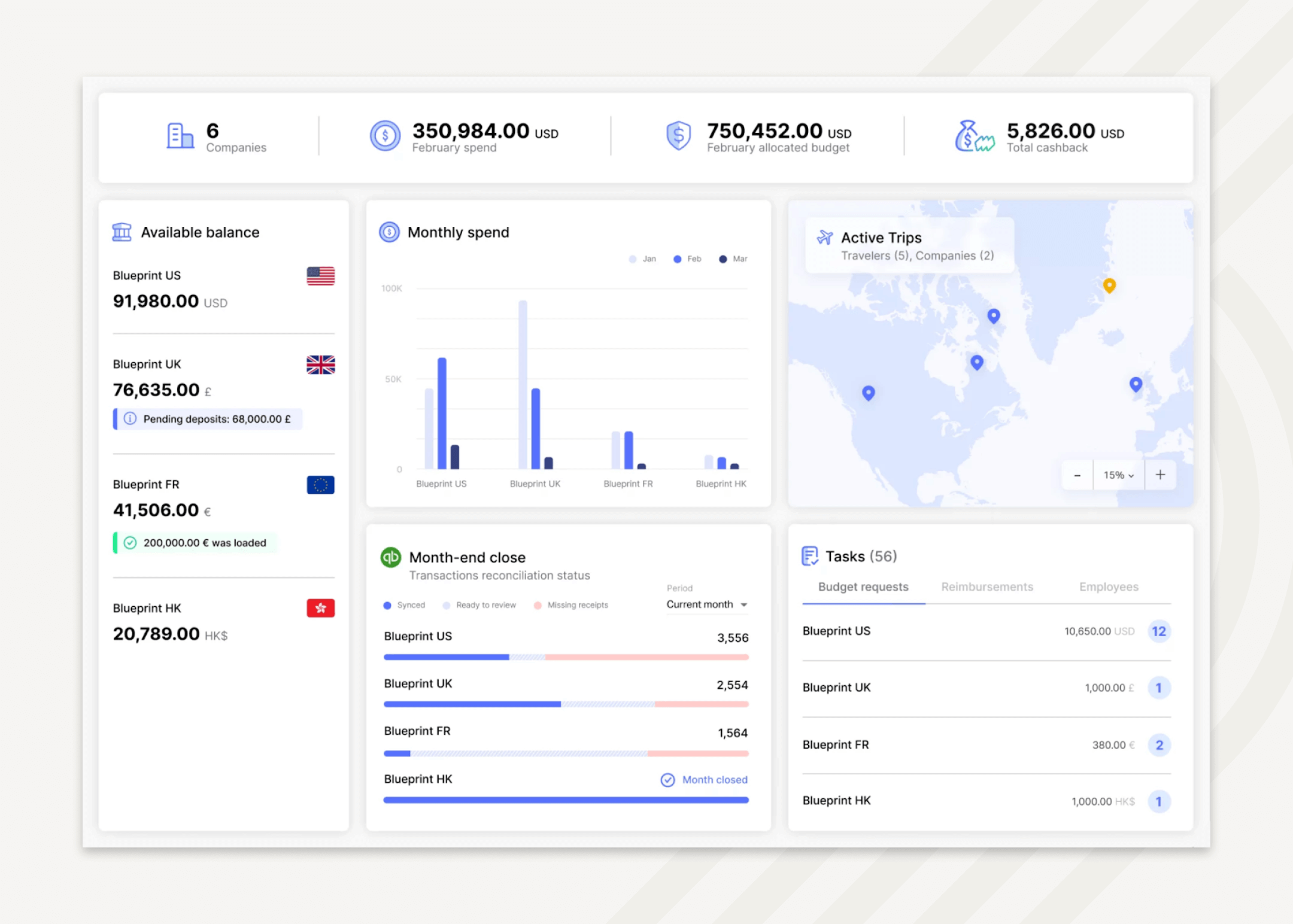

A consolidated view of all spend

Best features.

- Smart travel management: Offers multi-agency support, booking tools, and built-in policy enforcement to control spend.

- Expense management: Categorizes expenses with automatic matching of receipts, approval workflows, virtual cards, and quick reconciliation of transactions.

- Payment insights: Provides real-time data on each payment including SaaS subscriptions, travel expenses, and in-person purchases.

- Supports multi-subsidiary workflows: Offers a unified dashboard to track and manage receipt collection, categorization, subsidiary workflows, and reconciliation across subsidiaries.

Mesh Payments G2 rating: 4.6/5

Mesh Payments pricing.

Mesh Payments has three pricing packages — Pro, Premium, and Enterprise. While the Pro plan is free, the Premium plan is priced at $10 per user per month. The pricing for the Enterprise plan is customized based on the business’s specific needs.

Customers and best suited for:

- Company size: Small, medium, and large businesses.

- Solution needs: Businesses with international entities looking for features such as virtual cards, SaaS subscriptions, travel, and global spend management.

7. Coupa.

Coupa is a unified platform that helps businesses optimize their intake-to-pay processes. While it has advanced AP automation, intake, and payment features, Coupa is one of the viable Zip alternatives for those looking for comprehensive supply chain management features.

Rich vendor insights to optimize cost savings

Best features.

- Intelligent sourcing: Offers granular supplier insights, pre-built templates to create routine and complex sourcing events, and supplier collaboration tools.

- Guided intake: Combines workflow orchestration, budget insights, price comparison, and helps maximize price advantage.

- Seamless invoicing and AP automation: Enables 3-way PO matching and automates reconciliation in addition to supporting global e-invoicing and tax compliance.

- Comprehensive spend management: Monitors transactions for accuracy, identifies cost-saving opportunities, and flags potential fraud using AI-powered Spend Guard.

Coupa G2 rating: 4.2/5

Coupa pricing.

Coupa’s website does not list the packages or pricing information.

Customers and best suited for:

- Company size: Small, mid-market, and large enterprises.

- Solution needs: Businesses seeking a highly customizable, all-in-one platform that offers advanced procurement, AP automation, analytics, supplier, and treasury management.

Airbase vs Zip.

To go deeper into our Airbase vs Zip comparison, let’s take a closer look at the features they offer.

What does Airbase do?

Airbase is an all-in-one procure, pay, close platform that offers a consolidated solution for non-payroll spend management. With advanced features across the key areas of intake, AP automation, expense management, and corporate cards, Airbase offers a seamless way to bring spend under management. Its Spend Analytics provides department and vendor-level data and insights into company-wide spending.

In contrast, Zip offers basic AP automation that lacks direct payment integration. With customers making payments from NetSuite, the AP process ends up involving a lot of manual work.

Smart expense management features, comprehensive international payment support across 200 countries in 145+ currencies, a dedicated fraud investigation team, and flexible integrations are some of the features that set Airbase apart from Zip. The other areas where Airbase scores over Zip include OCR receipt scanning, receipt inbox, travel booking integration, and mileage calculation.

Airbase solutions.

Guided Procurement.

As Airbase’s advanced intake feature, the Guided Procurement module covers the entire spectrum of the procure, pay, close process to optimize company purchasing. No-code tools allow administrators to define the purchase policy and capture the unique documentation required for parallel or sequential approvals from procurement, IT security, legal, and other stakeholders.

The other area where Airbase shines over Zip is by offering highly customizable, multi-phase Guided Procurement workflows. This allows FP&A to ensure the budget is in place before vendor engagement is initiated. Unlike Zip, Airbase offers a mobile app that facilitates approvals on-the-go by providing approvers 360-degree insights on details, such as vendor, description, purchase amount, and category

Accounts Payable Automation.

Airbase’s industry-leading AP automation software eliminates the time and hassles of manual data entry, reconciliation, and the managing of multiple disparate systems. While capturing invoices automatically across subsidiaries, the platform curbs wasteful spending with a 3-way matching of invoices against item receipts and purchase orders while automatically coding, tagging, categorizing, and syncing transactions to the GL.

Expense Management.

The advanced expense management solution enables companies to stay on top of their expenses with advanced approval workflows, the ability to set customizable spend limits, and deep insights into spend. Travel booking integration and AI-powered OCR technology that enables employees to generate expense reports instantly from their receipts enhance employee experience and adoption.

Corporate Cards.

Airbase offers a versatile corporate card program with virtual, physical, and partner card integrations for AMEX and SVB. Transactions seamlessly sync to the GL thanks to Airbase’s integration with 70+ ERPs including Oracle NetSuite, Sage Intacct, and QuickBooks Online.

While Zip has a cap on the cash back offered through the virtual card program, Airbase provides unlimited cash back across all categories of spend.

What does Zip do?

Zip is primarily an intake workflow software designed to solve the major procurement challenges for mid-market to larger enterprises.

Users can leverage no-code workflows to route approvals for purchase requests and spend. Zip allows companies to sync their budget into the platform and offers insights into total spend, savings, and purchase cycle time on the centralized dashboard.

Procurement.

Zip allows users to set purchasing policies and routes requests to approvers based on hierarchies. The platform also allows users to store vendor agreements and syncs the budget to help approvers make informed approval decisions. It also offers easy bill and invoice creation and a vendor portal.

Sourcing.

Users can run RFx events from Zip requests or workflows and Zip maintains a record for each of these events. The platform uses AI to extract content from relevant documents and suggests suitable vendors. Once a vendor is chosen, their details flow into purchase requests eliminating the need to enter the information manually.

Global payments.

Zip supports payments in 40 currencies and 140 countries in addition to supporting payment runs and automatic routing of approvers for each subsidiary.

Vendor cards.

In 2023, Zip introduced the single-use virtual card offering with light control features. The platform generates these cards based on approvals while allowing users to define spend limits.

In summary.

Both Airbase and Zip offer procure-and-pay solutions, although Airbase is more comprehensive both in terms of breadth (procure, pay, close) and depth of features.

Airbase is featured as one of the top providers in the procurement landscape in International Data Corporation’s (IDC) report titled Procurement Applications Market Dynamics and Vendors for 2024. According to IDC, while Zip focuses solely on intake, Airbase covers the entire P2P lifecycle from intake to payments, optimizing vendor management and reconciliation.

When we look at Airbase and its competitors, it’s clear that the mature and comprehensive solutions Airbase offers make it a winner. Zip’s AP automation feature lacks the sophistication required by contemporary businesses. Plus, the prolonged payment processing times with Zip increase inconvenience for users. These are some of the pain points that Airbase addresses efficiently. Apart from advanced AP automation and deeper integration with GL and ERPs, Airbase differentiates itself with smart expense management, robust payment functionalities, and flexible corporate card solutions. Airbase’s customers are able to triple the percentage of spend under management with complete transparency over spend and granular approvals.

Although Zip has sourcing and spend management capabilities, these are at a nascent stage. Moreover, customers have to opt for different point solutions to manage vendors, AP automation, sourcing, and payments. Airbase provides Spend Analytics and reporting far beyond the basic offering from Zip.

Unlike Zip, Airbase offers fraud detection systems in addition to a full-time risk monitoring team to mitigate fraud.

Thanks to its intuitive interface, Airbase is recognized by G2 as the #1 Easiest to use Spend Management software, giving it a clear edge over its competitors.

See how Airbase represents the next generation of P2P solutions — book a demo with us!

Jira

Jira  Ironclad

Ironclad  Asana

Asana