AP Automation Software

Make AP Automation a touchless experience.

- Eliminate manual data entry and automate invoice processing.

- Increase accuracy and accelerate cycle times with AI-powered OCR.

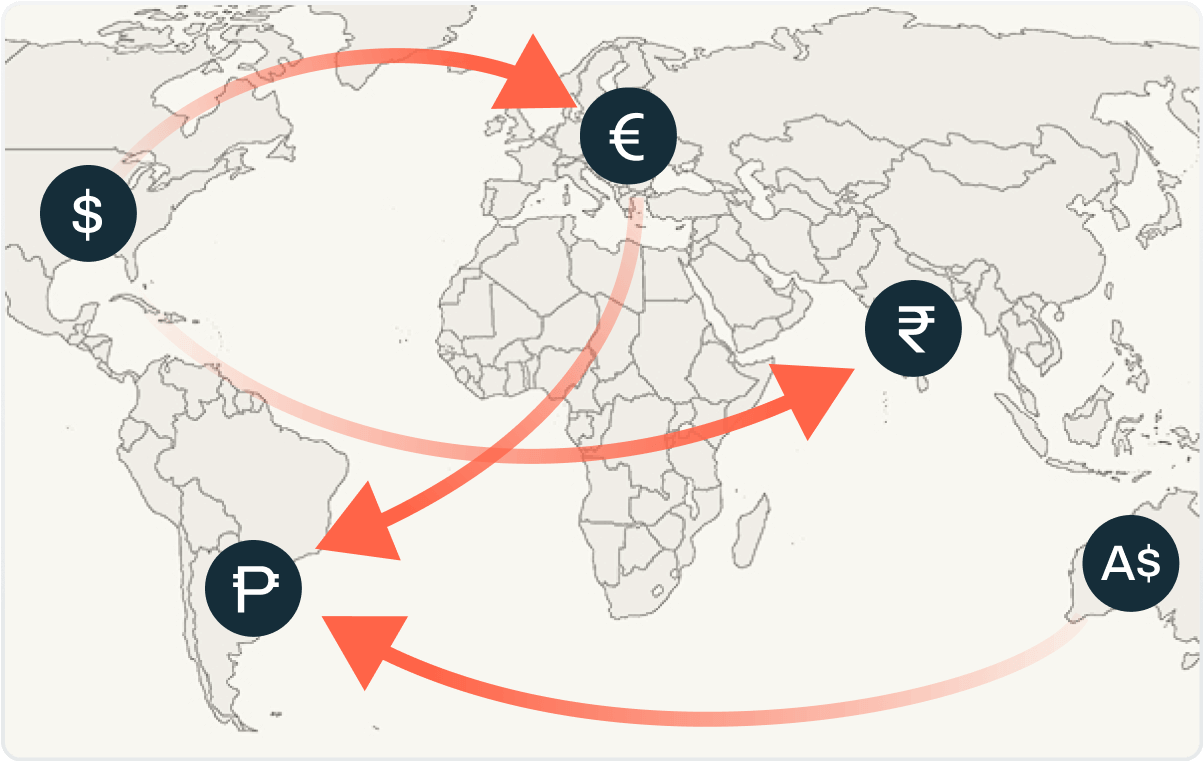

- Reduce risk with secure global payments in 145+ currencies and 200+ countries.

- Close the books faster with real-time sync to your ERP.

AI-powered touchless AP.

Automate the entire AP lifecycle, including vendor onboarding, invoice processing, bill coding, approvals, payments, ERP syncing, and spend analytics. Touchless AP Automation saves accounting and finance teams hours of manual tasks every week making them more available for strategic work.

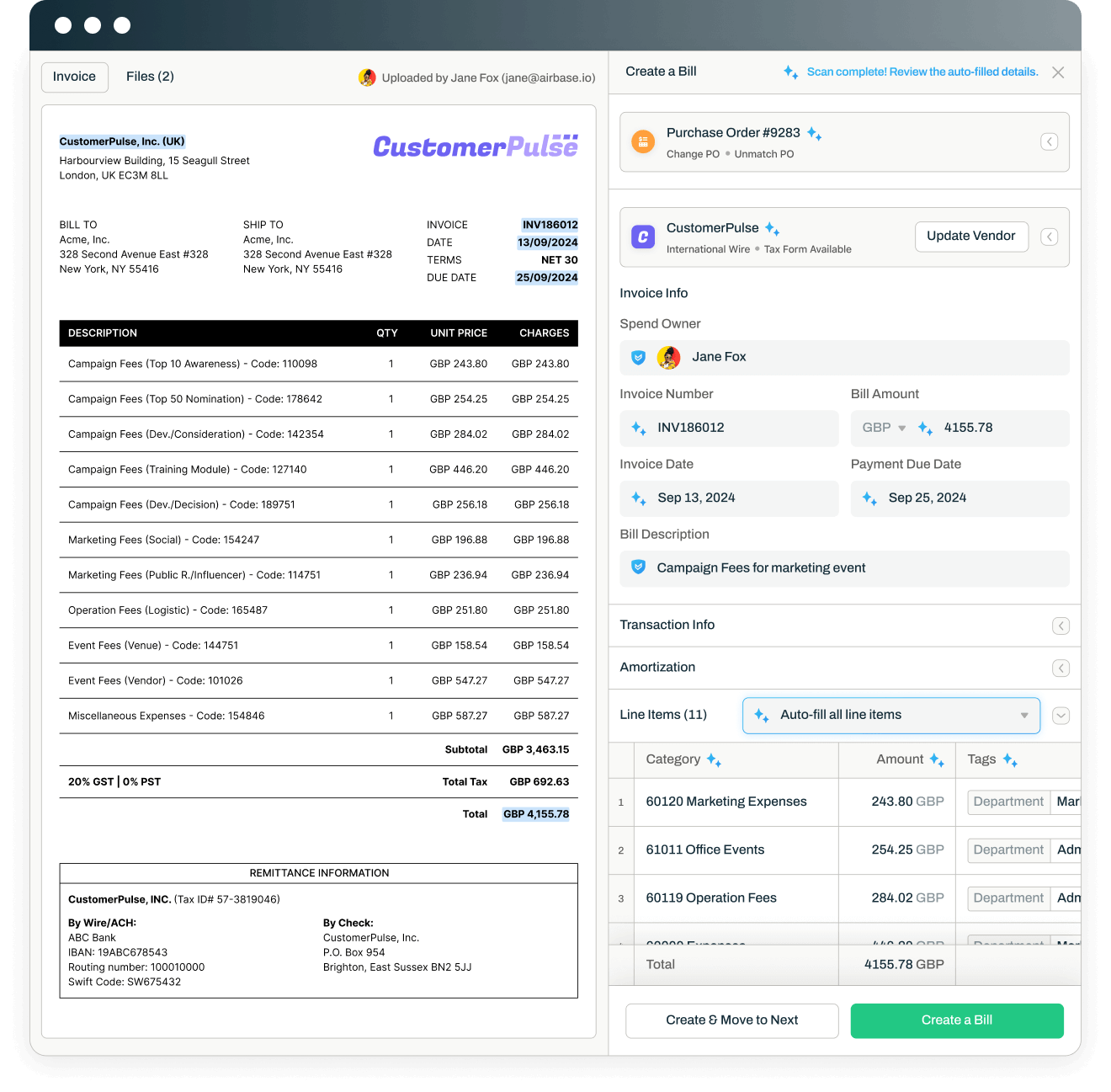

The magic of AI.

OCR automatically reads details from an invoice. Choose to have them coded at the line level, by vendor, or summarize the bill into one line item.

Generative AI and machine learning (ML) automatically populate the description and the category so that accuracy improves with every transaction. Save time and move from manual data entry to bill review.

Easy vendor onboarding.

Self-service vendor portal and workflows to provide contact, banking, and tax information, and strengthen your global vendor relationships. Vendors have visibility into the payment status of every invoice, and W-9 collection makes 1099 tax reporting a breeze.

Customize a vendor questionnaire to get the information that you need from vendors.

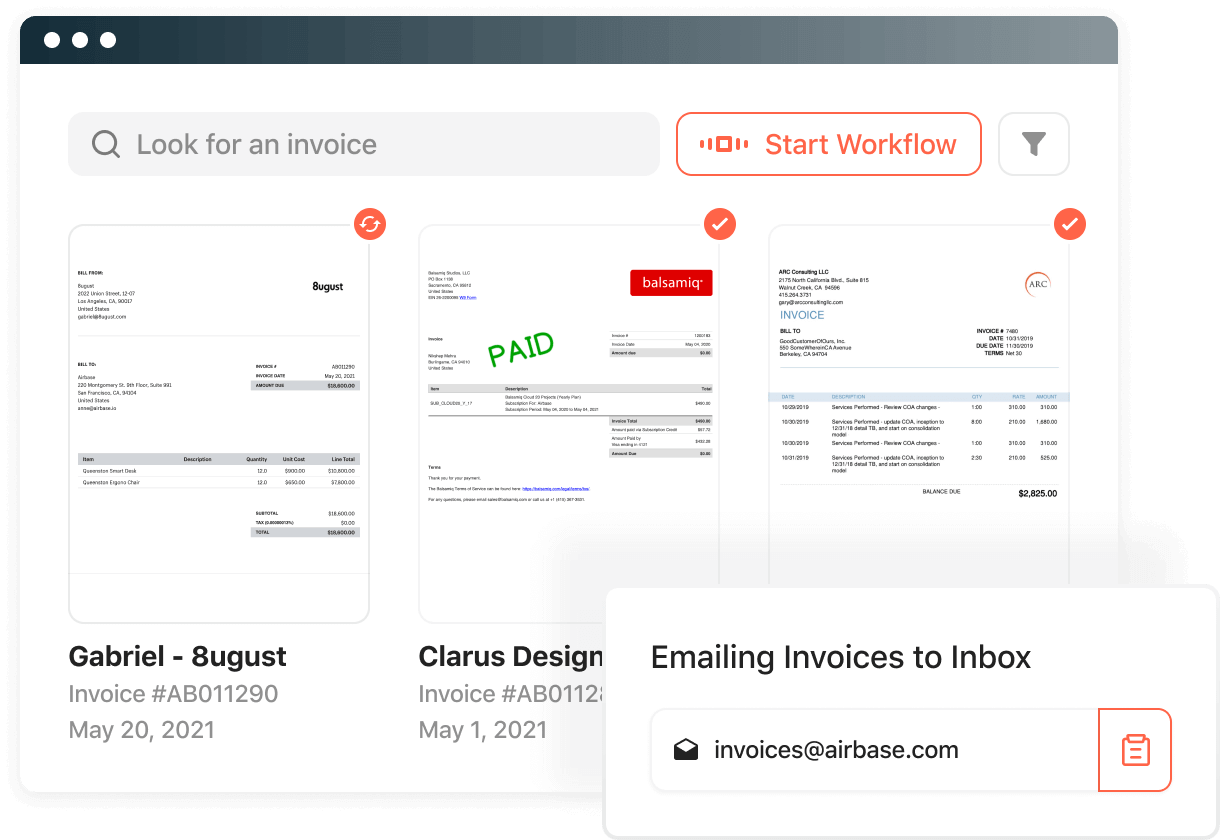

Airbase tells you the story behind every invoice.

Never have questions about an invoice again. Automatically capture and view invoices submitted via email or through the vendor portal across all subsidiaries. Get the full context of an invoice with automatic inclusion of email correspondence that relates to a vendor and a purchase.

Lightning-quick bill creation and approvals.

Scan and populate invoices using our AI-driven OCR technology to make bill creation accurate and easy. Automated approval workflows trigger the appropriate approvers and observers based on multiple parameters, including the vendor, amount, GL category, and more. Team members can review and approve bills via desktop, Slack, mobile, or email at a glance.

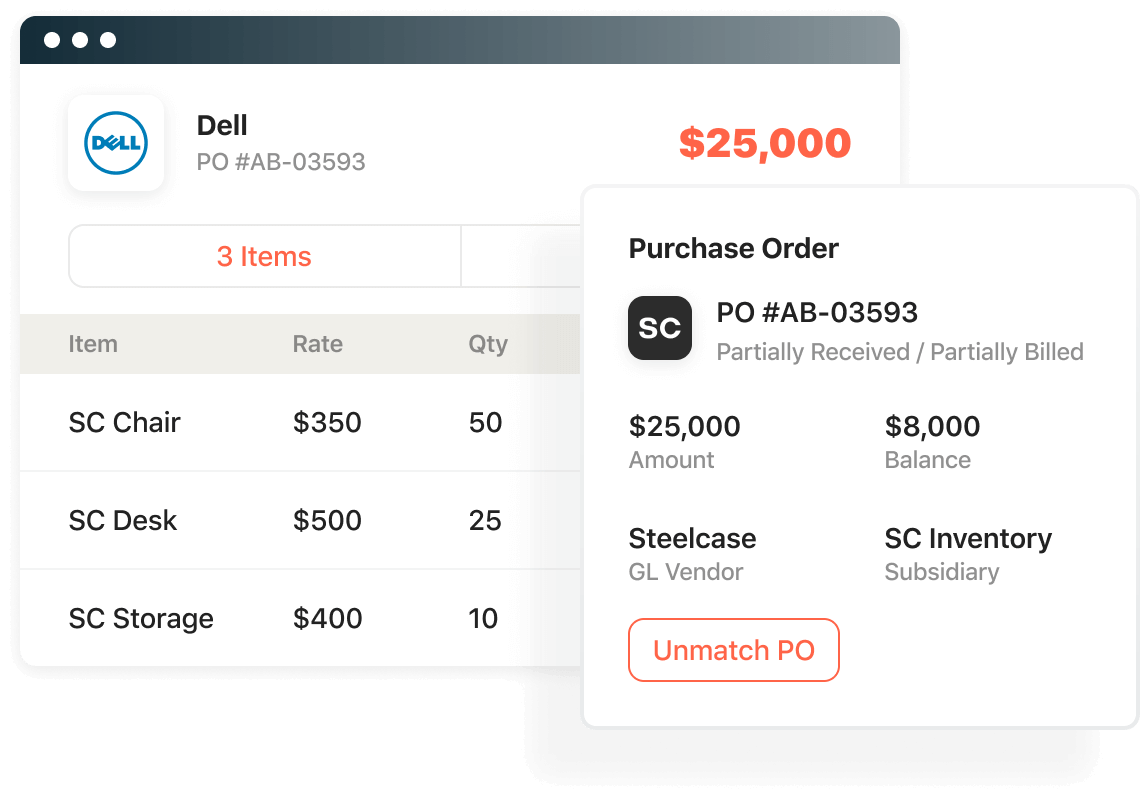

Automated 3-Way PO matching.

Increase efficiency and ensure audit readiness with automatic 3-way match of invoices against your synced NetSuite purchase orders and item receipts. Deep controls ensure your company gets exactly what you pay for to reduce wasted spend and ensure compliance.

Modern AP Automation Software

A Guided Procurement experience.

Guide employees thgouth the information and documentation they need to collect and the platform will route it directly to stakeholder software. Automate bill creation with AI-powered OCR and intelligence. Then easily make payments and let all approvals, documentation, and transaction details flow through Airbase to your GL.

Pay global vendors from any subsidiary.

Pay vendors in 200+ countries supporting 145+ currencies through ACH, check, virtual card, international wires, or vendor credits — all in one AP Automation software platform. Airbase will select the preferred payment vendor for each vendor and note where virtual card payments are accepted to earn cash back. Payment amounts can be split by category.

Automated compliance with real-time sync to the GL.

Ensure compliance, accuracy, and efficiency during an audit or month-end close. With intelligent automation, Airbase will auto-categorize expenses then automatically code, tag, and record transactions into your GL. Banking activity report with individual transactions makes month-end bank reconciliations a snap.

Purchasing made easy for every employee.

When employees across all business groups collaborate on the Airbase platform, communication is clear, compliance is ensured, and requirements for all stakeholders are secured. Modern spend management meets the complex procurement needs of many industry types. Automatically capture and track the data required by each department, enforce compliance, and gain real-time visibility into each step across the procure-to-pay process without the need of clunky antiquated solutions.

AP Automation FAQs

What is AP automation?

AP automation refers to the technology and software used to streamline and automate the accounts payable (AP) process.

It does this by digitizing and automating tasks such as invoice processing, data entry, payment approvals, and vendor management.

Airbase AP automation eliminates manual and time-consuming tasks, reduces errors, improves efficiency, and enhances visibility and control over financial processes. It includes features like invoice capture, workflow automation, automated payment processing, and integration with accounting systems.

Overall, AP automation simplifies and accelerates the AP process, leading to cost savings and increased productivity.

How does AP automation help AP teams?

AP automation streamlines and automates the AP process for improved efficiency and accuracy. Processes performed by AP automation include:

- Capturing invoices electronically and extracting relevant data using OCR technology.

- Matching invoices with the corresponding purchase orders and verifying them against pre-defined business rules.

- Routing invoices for approval based on customizable workflows.

- Executing electronic payments after approval.

- Updating the GL after a transaction.

- Facilitating comprehensive reporting for better visibility and control over the AP process.

How does AP automation software help finance teams scale?

Scaling comes with three challenges that AP automation can address: volumes, complexity, and risk.

It tackles volume by automating manual tasks like data entry, invoice processing, and payment approvals. This reduces processing time, improves efficiency, and allows companies to handle larger volumes of invoices without adding additional resources.

Secondly, AP automation simplifies complexity by providing a centralized platform for managing invoices, contracts, and vendor information. It streamlines workflows, improves collaboration, and enhances visibility into financial processes.

Lastly, it mitigates risk by enforcing compliance, reducing errors, and enhancing security through features like secure document storage and audit trails.

By addressing these challenges, Airbase AP automation supports company growth, improves scalability, and enables efficient financial operations.

How much money can a business save with AP automation software?

While the exact savings can vary, studies suggest that businesses can save between 40% to 80% on AP processing costs by adopting automation solutions.

By streamlining and automating manual processes, AP automation reduces the need for labor-intensive tasks, such as data entry and invoice processing.

Additionally, AP automation reduces the risk of errors and late payments, avoiding costly penalties and improving vendor relationships.

The improved visibility and control over AP processes also enable businesses to negotiate better terms and discounts with suppliers.

How does AP automation help the approval process?

AP automation streamlines and expedites the approval process. This ensures compliance with company expense policies, reduces bottlenecks, improves accountability, and ensures timely payments, enhancing overall efficiency and effectiveness in AP operations.

It accomplishes this by automatically routing spend requests to the appropriate approvers based on pre-defined workflows and business rules.

Approvers can review and approve from anywhere, at any time. This eliminates delays caused by manual handling and physical routing of paper invoices.

AP automation software also provides visibility into the approval status of each invoice, allowing stakeholders to track progress and take prompt action if needed.

Does AP automation improve supplier relationships?

AP automation can significantly improve supplier relationships. By automating AP processes, invoices are processed faster, leading to faster payments.

Suppliers benefit from reduced payment cycles, resulting in improved cash flow and increased predictability.

Airbase’s AP Automation module provides visibility into invoice status, allowing suppliers to track and monitor invoices.

Automated systems minimize errors and discrepancies, for accurate and efficient payment reconciliation. Plus, automation software can facilitate collaboration between buyers and suppliers, enhancing overall communication and fostering stronger relationships. These benefits contribute to increased trust, better communication, and improved satisfaction between businesses and their suppliers.

Can AP automation find duplicate payments?

Yes, AP automation solutions like Airbase can effectively identify and flag duplicate payments.

It does this through advanced algorithms and intelligent matching techniques to compare payment data against existing records in the system. It analyzes various factors, such as vendor names, invoice numbers, payment amounts, and dates to detect potential duplicates. If a potential duplicate payment is identified, the system sends an alert or notification for further review and verification by the AP team.

This helps prevent accidental or fraudulent duplicate payments, saving time and financial resources. The ability of AP automation to proactively identify and prevent duplicate payments contributes to improved accuracy, compliance, and cost savings for businesses.

How does AP automation intake vendor invoices?

AP automation simplifies the intake of vendor invoices by automating the following processes:

- Invoice Capture: Invoices are received electronically through email via an invoice inbox, or uploaded directly to a portal.

- Data Extraction: OCR technology extracts relevant data from the invoice, including vendor details, invoice number, amounts, and line items.

- Validation and Verification: The software validates the invoice data against pre-defined business rules, checks for errors or discrepancies, and matches it with POs or other supporting documents if applicable.

- Workflow Routing: The software automatically routes the invoice to the appropriate stakeholders for review, approval, and coding. In Airbase, this can happen within business systems used by the approvers, such as Jira.

- Integration with ERP: Once approved, the invoice data is seamlessly integrated into the ERP system for accurate record-keeping and payment processing.

By automating these steps, AP automation streamlines the intake process, reduces manual effort, minimizes errors, and improves the overall efficiency of handling vendor invoices.

What is the best AP automation software?

The best AP automation software will depend on your specific requirements. It’s important to do a thorough evaluation of any platform to determine if it’s a good fit.

Because requirements often change with growth, the best platform will be flexible and scalable. Airbase’s modular approach shows how AP automation software can adapt to evolving needs, including foreign and domestic multi-subsidiary support.

Research shows that employees won’t use a solution if it’s not easy to use. Even the most sophisticated software won’t be a good fit if you don’t have company-wide adoption. The best AP automation solutions are easy to use and don’t require extensive onboarding or training.

For some companies, AP automation forms one component of a larger spend management platform, including procurement, expense management, and corporate cards. This offers the additional benefits of a consistent user experience and a unified view of all company spending.

How does AP automation help with invoice processing?

Learn why Airbase is a Leader in AP Automation.

Jira Integration – Streamline Your Workflows

Jira Integration – Streamline Your Workflows  Ironclad Integration – Simplify Legal Operations

Ironclad Integration – Simplify Legal Operations  Asana

Asana