Why look for Brex alternatives?

Brex was established in 2017 as a spend management platform that initially focused on serving startups and small businesses with tailored credit cards.

In 2022, Brex shifted its focus from smaller segments to the mid-market and bigger venture-backed businesses, adding capabilities such as accounting automation, bill payments, and corporate cards.

However, Brex lacks the advanced procurement, spend management, and AP automation solutions that modern businesses require. With this in mind, we’ve collated a list of 11 alternatives to Brex that may align with your needs.

Comparison criteria.

Here’s the criteria we used to evaluate Brex alternatives:

- The platform’s capabilities.

- Pricing structure.

- Reviews and ratings.

- User interface.

Overview: Brex alternatives and competitors.

| Competitor | Top Feature | Primary Market | G2 Rating | Pricing |

| Airbase | P2P | Mid-market | 4.8 | $$ |

| Emburse Chrome River Expense | Expenses | Global companies and large enterprises | 4.3 | $$$ |

| eRequisition | PO management | Small to medium-sized businesses | NA | $$$ |

| MineralTree | Accounts payable | Mid-market and enterprises | 4.5 | $$$ |

| PayEm | Expenses | Small to large businesses | 4.8 | $$$ |

| Pipefy | P2P | Small teams to enterprises | 4.6 | $$ |

| Procurement Express | Purchasing | Small and medium businesses | 4.7 | $$$ |

| Quick Payable | Expenses | Small to large businesses | 5.0 (based on one review) | $$ |

| Teampay | Expenses | Small to mid-market and enterprise | 4.4 | $$$ |

| ChargeBee | Subscription management | Small to large businesses | 4.4 | $$ |

1. Airbase.

Airbase is an all-in-one spend management platform designed to streamline and automate the entire expense management process for businesses.

Airbase supports advanced approval workflows across subsidiaries

Best features.

- Comprehensive procure, pay, close solution: Integrates intake, AP automation, expense management, and corporate cards to streamline financial processes.

- Mature AP automation: Expedite month-end closing with features like seamless bill creation, 3-way PO matching, auto-categorization of expenses, and seamless integration with GL systems.

- Robust payment capabilities: Streamline vendor payments and employee reimbursements with direct payments, multi-currency payment support, and the flexibility to link multiple banks to a subsidiary for seamless transactions.

- Deep integrations: Seamless connectivity with HRIS, communication tools, contract management tools, native and custom integrations with major GLs and ERPs.

- AI-powered expense management: Pre-approved corporate cards, OCR receipt scanning, AI-generated expense reports, custom approval workflows, and seamless travel booking integration.

- Continuous fraud detection: Fraud investigation team and advanced tools to detect and prevent transaction fraud.

Airbase G2 rating: 4.8/5

Airbase pricing.

Airbase offers three packages: Standard, Premium, and Enterprise. All the packages include key platform features while optional add-ons are available for travel, POs, and approval workflows. Users can also opt for individual modules instead of the whole platform.

Customers and best suited for:

- Company size: Mid-market to large enterprises (with 50 to 10,000 employees).

- Solution needs: Businesses looking for an all-in-one platform with advanced modules of Guided Procurement, Account Payable Automation, Expense Management, and Corporate Cards.

2. Emburse Chrome River Expense.

If you’re searching for an alternative to Brex that caters to complex needs of global enterprises, Chrome River is worth exploring. As the enterprise solution from Emburse, Chrome River provides travel, expense, and accounts payable automation in addition to powerful analytics.

Dashboard with detailed spend analytics

Best features.

- AP automation: Automated workflows, OCR technology to capture invoices, data-enabled vendor negotiations, and the ability to purchase directly from vendors’ e-catalogs.

- Mobile tools: A single app for travel management, capturing receipts and receiving in-app messages for important travel details.

- Physical and virtual cards: Emburse Card with spend controls, rule-based approval flows, and automatic expense categorization.

- Real-time analytics: Comprehensive dashboards and detailed reports to understand spend and risk scores while predicting future spending.

- Global payments and reimbursements: Multi-currency payments and reimbursements securely via ACH, virtual cards, or checks, with instantaneous funding requests and approvals.

Emburse Chrome River Expense G2 rating: 4.3/5

Emburse Chrome River Expense pricing.

Emburse has not listed the pricing information on its website.

Customers and best suited for:

- Company size: Enterprises and global companies.

- Solution needs: Multi-entity companies looking to invest in a configurable expense, accounts payable, and payment software.

3. eRequisition.

With a similar pricing model, eRequisition emerges as one of the affordable Brex alternatives that makes the purchasing process simple for small businesses and startups. With eRequisition, companies can manage requisitions, create purchase orders, and seamlessly communicate with suppliers, all within a user-friendly platform.

Set unique approval flows for each individual

Best features.

- Custom approval flows: Assign approval flow for the entire company or unique workflows for each individual, set amount limits, and tag departments.

- Purchase order management: Select vendors and automate creation and sending of purchase orders.

- User management tools: Customize user access rights, define permissions for creating requisitions or purchase orders, and set up a hierarchy to control purchasing and receiving operations.

- Requisition tracking: Track requisition status, including pending approvals and approver details.

- Collaboration: Discuss requests and address purchase concerns through the integrated chat tool.

- Master data management: Centralized portal to manage vendors, item catalogs, and price lists.

eRequisition G2 ratings: Not available.

eRequisition pricing.

The eRequisition Standalone plan is for those who are already using QuickBooks. For single users, the pricing starts at $15 per month for up to 5 users while bulk user pricing ranges from $145 for 10 users to $1600 for 200 users. The price goes up if you opt for NetSuite or QuickBooks integration with the platform.

Customers and best suited for:

- Company size: Startups, small, and medium businesses.

- Solution needs: Companies looking for a low-cost purchasing management software.

4. PayEm.

PayEm is one of the viable alternatives to Brex, offering comparable spend management features. Both platforms provide corporate cards, expense management, invoice processing, and budget tracking capabilities. However, PayEm lacks the travel management and advanced AP automation features found in Brex.

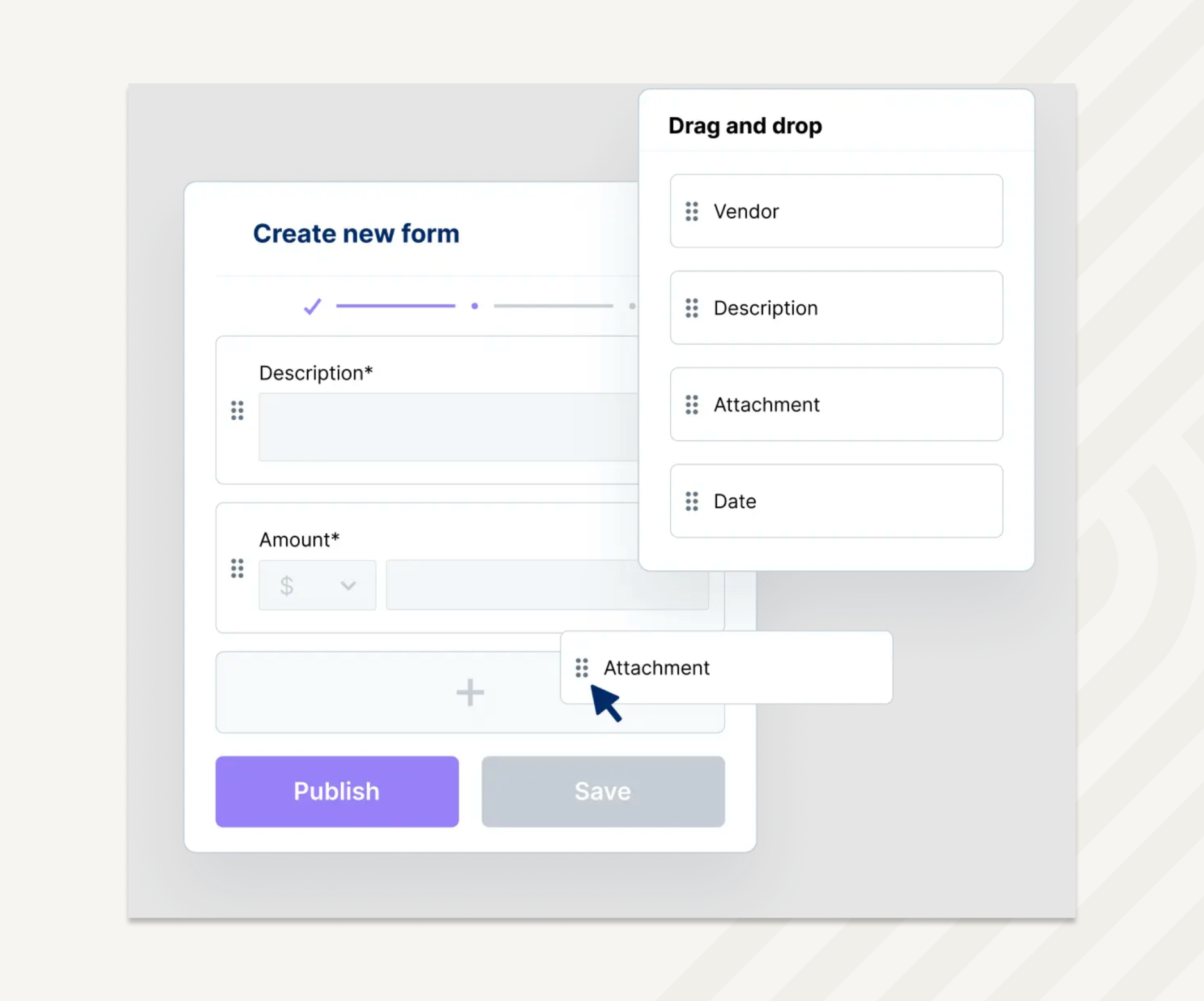

Drag-and-drop tool to create purchase request forms

Best features.

- Request forms: Tailor request forms to capture specific details for various needs.

- Approval workflows: Dynamic approval processes integrated with ERP and HRMS data.

- AI-powered invoice processing: OCR and ML-based invoice data extraction, approvals on Slack and email, and bulk invoice processing tools.

- Budget visibility: PayEm calculates the difference between budgets and payments, including in-process POs.

- Insights dashboard: View company spending, forecast spending trends, and detect duplicate payments.

- Corporate cards: Assign physical and virtual cards to specific budgets or purchase orders.

PayEm G2 rating: 4.8/5

PayEm pricing.

Pricing information is not available on the company’s website.

Customers and best suited for:

- Company size: Mid-market companies

- Solution needs: Businesses and finance teams in need of a spend, PO, and invoice management platform.

5. MineralTree.

MineralTree, like Brex, caters to mid-market companies by providing solutions for AP automation, invoicing, and bill payment. However, MineralTree lacks certain features offered by Brex, such as AI-powered workflows, budget tracking, and comprehensive expense management.

A 3-step process to fast-track payments to vendors

Best features.

- AP automation: Captures and automatically codes invoice data, carries out PO matching, and syncs transactions to GL or ERP.

- Approval workflows: Enables custom approval workflows based on multiple attributes and automates reminders to fast-track approvals.

- Invoice capturing and matching: Automatically captures and codes header and line-level data while ensuring 2-way or 3-way PO matching.

- Payment processing: Automates batch payments to minimize transaction costs and maximize rebates.

- Virtual card: Offers SilverPay, a virtual card payment method while MineralTree’s team contacts vendors to update the list of accepting vendors.

MineralTree G2 Rating: 4.2/5

MineralTree pricing.

MineralTree charges an upfront fee for ERP integration, onboarding, and training. In addition, MineralTree charges an annual fee based on payment and invoice volumes unlike most Brex alternatives with a user-based fee model.

Customers and best suited for:

- Company size: Mid-market companies and enterprises.

- Solution needs: Businesses focusing on AP automation and bill payment.

6. Pipefy.

Brex AI’s capabilities extend to smart budget assignments, real-time insights on spend, and GL coding suggestions. However, if you are looking to hand over the creation of custom approval workflows and processes to AI, Pipefy is one of the Brex competitors to look at.

Centralized view of requests, invoices, suppliers, and payment status

Best features.

- Custom workflows: Build custom workflows using AI or customizable templates.

- Procure-to-pay: Automate requests, quotes, supplier selection, approvals, and follow-ups.

- Document storage: Secure portals for organizing records and documents.

- Supplier portals: Vendors can update information, submit invoices, and monitor payments on a unified platform.

- Smart suggestions: AI-enabled insights on ideal quantities and suppliers for requisitions based on buying data.

- Rapid workflow deployment: Deliver digital transformation with a secure, AI-powered workflow management platform that empowers business teams and implements up to 2X faster than other solutions.

- Automated approval: Automatically turn purchase requests into cards for approval, assign approvers, and set review SLAs.

Pipefy G2 rating: 4.6/5

Pipefy pricing.

Pipefy is one of the few Brex alternatives to offer a free Starter plan for small teams. The Business plan costs $20 per user per month and the Enterprise plan is priced at $34 per user per month.

Customers and best suited for:

- Company size: Startups, small to medium-sized businesses.

- Solution needs: Businesses looking for an AI-powered platform to build P2P workflows.

7. Procurement Express.

If simplified purchase order management and e-commerce integration are your priorities, one of the Brex alternatives to consider is Procurement Express. Apart from making it easy to create and manage POs, the platform offers sourcing and vendor management tools.

Dashboard with an overview of purchase order history

Best features.

- Detailed record keeping: Track the complete history of individual POs, including custom notes for updates or additional information.

- Professional POs: Utilize drop-down menus and custom fields to create professional POs.

- E-commerce punch outs: Convert online shopping cart orders into draft POs.

- Invoice management: Scan receipts and leverage OCR-based invoice data extraction and intelligent PO matching.

- Adaptable approvals: Set predetermined approval levels, with automatic escalation for higher value POs.

- Centralized data: Gain complete oversight with a centralized hub for all invoices, performance metrics, pending POs, and budgets.

Procurement Express G2 rating: 4.7/5

Procurement Express pricing.

Procurement Express offers four pricing tiers: the Basic plan starts at $365 per month, the Better plan at $730 per month, the Best plan at $1825 per month, and the Enterprise plan with custom pricing tailored to your specific needs. Users may also need to pay an initial set up fee of $2000.

Customers and best suited for:

- Company size: Small and medium businesses.

- Solution needs: Companies in search of a simple platform that streamlines procurement processes with e-commerce punch outs.

8. Quick Payable.

Quick Payable is a Salesforce app that helps businesses manage their accounts payable processes by automating invoice data capture, approvals, and ERP integration.

Approvers receive an email notification when new invoices arrive

Best features.

- Automatic identification: Quick Payable identifies approvers automatically from invoice data captured in an email.

- Approver notification: Approvers receive email notification when a new invoice is submitted.

- Invoice export: Users can export approved invoices as CSV to ERPs for payment.

- Vendor management: Handle vendor information and interactions.

- GL code management: Assign GL codes to vendors and line items/invoices.

- Invoice handling: Options to hold, re-route, or report issues with invoices.

Quick Payable G2 rating: 5/5 (based on 1 review)

Quick Payable pricing.

Users can try out the app’s features with a 7-day free trial. The paid plan costs $65 per user per month.

Customers and best suited for:

- Company size: Small to large businesses.

- Solution needs: Companies in need of a lightweight Brex alternative that offer AP management tools.

9. Teampay.

Teampay shares its core features of AP automation, expense management, virtual cards, and guided purchase with Brex. It is one of the Brex competitors to explore if your business relies on Slack to manage business processes.

Teampay automates approvals based on company policies

Best Features.

- Spend data capture: Spend data is coded upfront as purchases are approved, populating real-time insights into the reporting dashboard.

- Purchase assistance: Purchase Assistant connects with Slack and Microsoft Teams, enforces spending policies automatically, and routes requests to defined approvers.

- Policy engine: Allows easy adjustments to spending rules, adapting to market and economic changes without the need for extensive retraining.

- Automatic reconciliation: Transactions are automatically reconciled and synced with accounting software.

Teampay G2 Rating: 4.4/5

Teampay Pricing.

Pricing information is not available on Teampay’s website.

Customers and best suited for:

- Company size: Small to mid-market businesses and enterprises.

- Solution needs: Companies looking for AP automation and spend management software that integrates with Slack.

10. Chargebee.

While it is not one of the most affordable Brex alternatives out there, Chargebee is an ideal subscription billing software for SaaS and subscription-based companies. In addition to automating billing and invoicing, Chargebee supports global payments and offers integrations with e-commerce stores and accounting software.

Convert a quote into an invoice in seconds

Best features.

- Subscription management: Automates the subscription lifecycle, from trial to retention, with tools for managing upgrades, downgrades, and renewals.

- Recurring billing: Billing LogIQ facilitates flexible calendar and usage-based billing cycles, automatic proration calculations, advanced and consolidated invoicing.

- Subscription reports: Reports Explorer offers 80+ predefined reports with multiple visualization options while users can build custom dashboards.

- Payment: Integrates with 30+ payment gateways that support payments in 100+ currencies.

- Multi-entity management: Manage subscription data and automate workflows across all business entities in a single platform for improved efficiency.

- Automated reconciliation: Chrome plugin to reconcile gateway transactions on Stripe with accounting software.

Chargebee G2 rating: 4.4/5

Chargebee pricing.

The Starter plan is free for the first $250K of cumulative billing, after which a monthly charge of 0.75% applies. The Performance plan costs $599 per month for up to $100K in monthly billing, with a 0.75% fee on additional billing. The Enterprise plan provides a custom pricing structure based on specific requirements.

Customers and best suited for:

- Company size: Small to large businesses.

- Solution needs: Businesses looking for subscription and recurring billing management solutions in addition to revenue recognition.

Airbase vs Brex.

Here is our in-depth Airbase vs Brex comparison to help you make an informed choice.

What does Airbase do?

Airbase empowers businesses with end-to-end solutions that maximize control, visibility, and efficiency in their financial operations.

The platform’s core modules are Guided Procurement, Accounts Payable Automation, Expense Management, and Corporate Cards.

Airbase solutions.

Guided Procurement.

Airbase offers Guided Procurement, an intuitive intake module that removes the hassles and manual work associated with the purchasing process.

With comprehensive vendor management tools and integrations with top-tier systems such as Jira, DocuSign, and Ironclad, Airbase unites different stakeholders and provides them with the necessary information they need, at the right time.

Customizable forms with call-outs for attachments, URLs, and more capture detailed information while employees are guided through each step, including gathering information, creating purchase orders, requesting virtual cards, and securing approvals.

Accounts Payable Automation.

With one of the most mature accounts payable automation modules in the market, Airbase optimizes every aspect of your AP process. Some of the areas where Airbase outshines Brex are advanced approval flows for expenses, POs, and bills. Admins can create advanced approval flows while establishing approval groups, parallel or sequential flows, and set up contingencies for automatic rerouting.

Airbase also offers other features that are lacking in Brex, including PO matching, payment runs, and payment amortization. Airbase supports payments to vendors in 200+ countries and 145+ currencies through various methods, including ACH, check, virtual card, international wires, and vendor credits. Automated compliance is guaranteed with real-time synchronization to the GL, ensuring accuracy and efficiency during audits or month-end close processes.

Expense Management.

From capturing receipts and categorizing expenses to enforcing spending policies and generating insightful reports, Airbase provides a centralized platform for managing expenses.

The platform employs cutting-edge OCR, ML, and AI technologies to extract data from receipts and invoices, intelligently categorizing expenses and identifying potential policy violations. By seamlessly capturing card transactions, mileage data, and integrating with travel booking tools, Airbase streamlines the process of capturing and reconciling different types of spend.

Corporate Cards.

Airbase’s Corporate Card module is tailored to the unique needs of modern enterprises. With virtual cards, employees gain instant access to funds for online transactions, while physical cards provide flexibility for in-person purchases. The platform empowers finance teams with robust spend controls, allowing them to set limits, restrict categories, and enforce policies in real time.

Airbase also stands out with its unlimited cash back with no promotional periods involved.

What does Brex do?

Brex offers a range of tools to help businesses manage their financial operations, including corporate credit cards, business banking, accounting automation, and bill pay services. In addition, Brex offers Live Budgets, empowering businesses to monitor and manage their budgets in real time.

Accounting automation.

Brex accounting automation leverages AI to spot anomalies, automate tasks, and offer suggestions on GL coding. The platform supports multi-entity management, providing centralized controls and enabling setting of localized policies.

The software integrates with ERPs and enables auto-categorization of spend.

Expense management.

Brex utilizes AI to streamline expense management which ensures receipts are compliant with regulations in addition to generating memos, and populating fields. Admins can define budgets for departments and create approval policies for departments, entities, use cases, and other criteria while reimbursing employees within the U.S. and in 70 other countries.

Users can leverage natural language search to get data on spending patterns or ask questions on allowed spend limits for different categories. One of the useful features that Brex has is that it attaches a virtual receipt automatically to transactions made with common vendors, such as Amazon.

Global payments.

In place of the dedicated vendor portal that Airbase offers, Brex sends a link to vendors to enable them to enter their payment details. Brex AI captures the itemized details from invoices uploaded to the platform or sent via email. Admins can issue a virtual card to make payments to vendors or transfer money from a Brex business account, wires, ACH, or checks.

Notably, Brex does not offer bulk bill payments.

Corporate cards.

With Brex, companies can issue virtual and physical cards on the Mastercard network in addition to local currency cards in 20 currencies. Businesses can create customized spend limits for different types of spend, including travel, stipends, and procurement. Brex allows admins to set spend controls for specific vendors and categories, while blocking unwanted merchants. Brex AI enforces the policies across the travel, bill pay, and reimbursement platforms.

Brex allows users to redeem their accumulated points for gift cards, cryptocurrency, travel perks, or cash back.

In summary.

When comparing Brex and Airbase, it’s evident that while both offer valuable financial solutions, Airbase emerges as the more comprehensive and advanced option, particularly in accounts payable automation, corporate cards, and expense management features.

Airbase is also the top choice for businesses seeking holistic procure, pay, close solutions that include industry-leading procurement software.

Brex’s accounting automation is limited to international bill payments and bill creation and lacks features that Airbase offers, such as automated PO creation, PO matching, and OCR technology to facilitate touchless invoicing and expense report creation.

In comparison with Brex that offers a limited number of integrations with ERPs, Airbase integrates with 70+ ERPs including a deep integration with NetSuite. Its fast syncing capabilities enable near-instantaneous transfer of expense data, ensuring that financial records remain up to date at all times.

Moving on to reward points on card transactions, Airbase offers unlimited cash back on every type of spend without any gimmicks or caveats. In contrast, Brex offers rewards with unclear value while charging a fee for redemptions of points. Brex’s sudden devaluation of reward points by 40% in 2023 eroded trust, especially since there was no prior notice given.

Airbase has earned the trust of its client base, emerging as the most user-friendly platform with a focus on innovation and high-quality customer support.

See how Airbase represents the next generation of P2P solutions — book a demo with us!

Jira

Jira  Ironclad

Ironclad  Asana

Asana