Build a great company with better spend management.

Manage all non-payroll spend with one powerful, scalable solution.

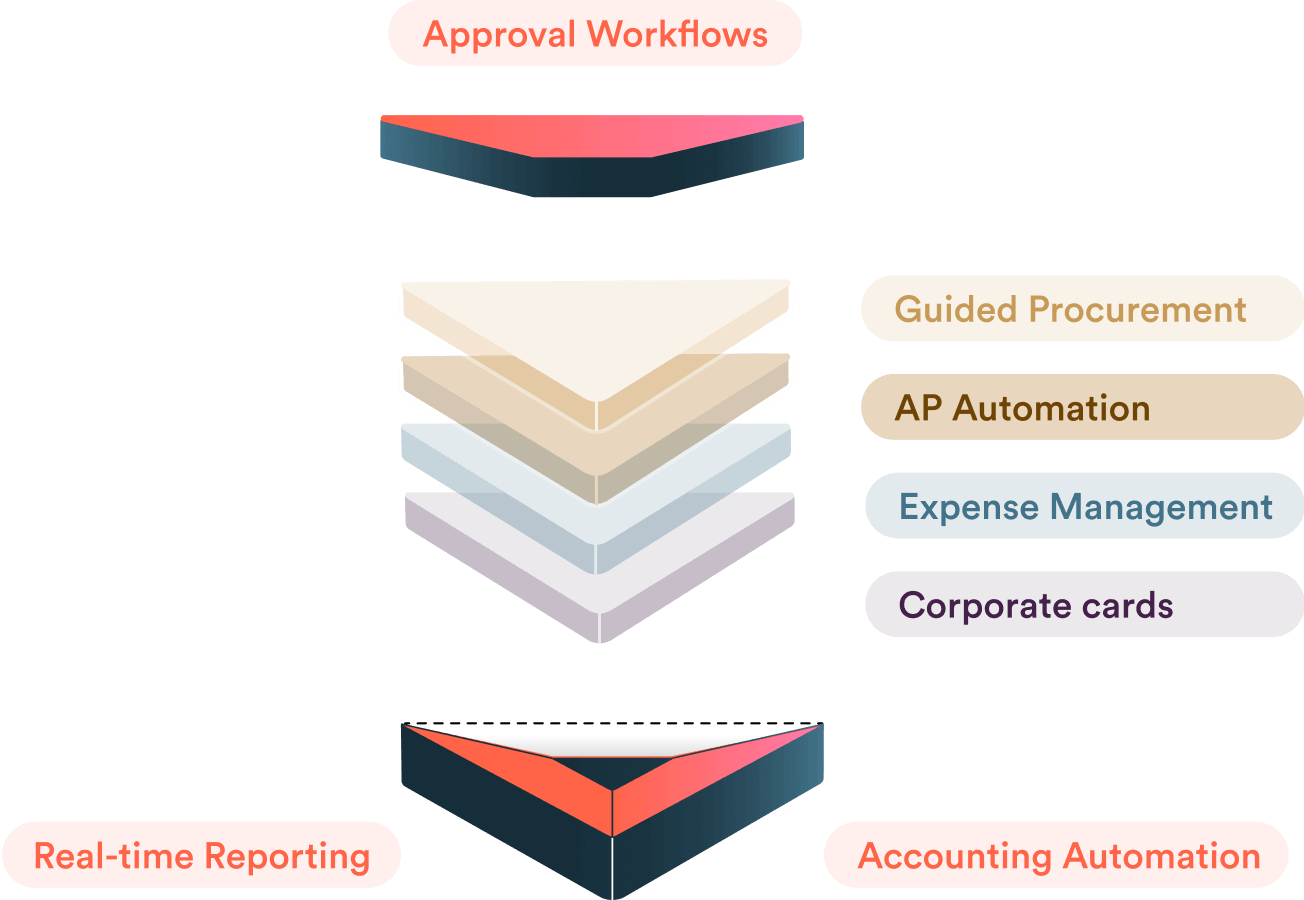

Spend management essentials.

Get the approvals, automation, and reporting you need. Keep your company growing with the one true platform solution.

A new approach with a significant and positive impact.

Airbase solves so many daily problems, large and small, for so many stakeholders — accounting and finance teams, budget owners, employees, leadership, partners, and vendors. What’s more, Airbase consistently delights users with its intuitive interface and above-and-beyond functionality.

It replaces a messy financial tech stack with one clean solution. It does the job (and more) of the many siloed software products commonly relied on to pay vendors, manage card spending, and reimburse employees — you know, the usual suspects, Bill.com, Expensify, and corporate card programs. But, because Airbase does it all, Airbase does it better. It standardizes practices, eliminates reconciliations, creates a complete audit trail, and forms a single source of truth. Pure magic.

Designed to scale.

Airbase integrates with NetSuite, Sage Intacct, QuickBooks, and Xero to meet your company’s needs, no matter its stage and complexity. You can rely on Airbase to scale with you.

The meta problem Airbase solves.

The inefficient deployment of company capital and human resources constrain growth and create risks. Yet non-payroll spending, an essential function to control budgets and optimize returns, is often handled with outdated, partial solutions and excessive manual work.

Done right, company spend is an automated process, from an initial request/approval for all purchases to booking to the GL. Done wrong, it’s a time-consuming, error-prone exercise-in-frustration with inefficient operations, wasted spend, lack of visibility, and books that take way too long to close. Airbase’s spend management solution is the only one that truly delivers on “done right.”

The beauty of a fully automated platform solution:

How we do it.

Benefits.

Consolidates card spend, purchase orders, simple invoices, or expense management.

Consistent visibility into all non-payroll spend.

One command and control center to make payments by check, ACH, or card.

Reduces processing costs and lets AP optimize for cash back.

Guided purchasing process with no-code departmental requirements built in.

Compliance, visibility, and control for every purchase.

Set expense policies with rules the system will enforce.

Automates bill creation, categorization, payment scheduling, accruals, amortizations.

Features:

Platform features extend across all products and include:

- Automated approval workflows

- Real-time reporting

- Full audit trail of supporting documents

- Automatic GL sync

- Vendor management

- Notifications via web, email, and Slack

- Mobile app

Unlike other spend management systems, each of Airbase’s products has great breadth and depth that rival other point solutions.

Guided Procurement

AP Automation

Corporate Cards

Expense Management

Guided Procurement

- No-code customizable P2P workflows

- Automated, multi-step request submission process

- Sequential and parallel department approvals

- Customizable approval matrix, request forms, and approvers

- Dynamic conditions based on intake responses and additional parameters

- Integrations with IT, finance, and legal systems of record such as Jira, Ironclad, Asana, and more

- Complete audit trail with all supporting documentation

AP Automation

- Invoice ingestion & OCR

- Invoice inbox

- Simple bill creation

- Auto categorization

- 2-way and 3-way PO matching

- Payment scheduling

- Domestic and international payment support with multiple payment types: ACH, check, wire transfer, virtual cards with cash back

- Create recurring bills

- Vendor payment history

- Vendor portal

- Search, setup, W-9 capture for vendors

1099 reporting - Search, setup of vendors

- Vendor invoice upload

- Payment visibility for vendors

- Audit trail of all invoice activity including email content

Expense Management

- Real-time expense requests

- Powerful rule-based expense policy controls

- Blocking and warning policies for hard or soft policy compliance

- Clear policy visibility for employees

- Receipt compliance settings

- Receipt inbox

- Simple receipt upload

- Automated payments

- Real-time reimbursement status

for employees and approvers - Same-day expense processing

Corporate cards

- Physical cards with cash back

- Unlimited virtual cards with cash back

Card features include:

- Set spend limits based on amount, time, and number of transactions

- One time and recurring virtual cards

- Vendor specific virtual cards

- Auto categorization

- Google Pay and Apple Pay support

- Auto card lock settings

- Simple receipt upload

- Receipt compliance settings

- Subscription management

- Duplicate subscription checking assistance

- Virtual card expirations to avoid auto-renewals

- Subscription renewal warnings for owner and accounting team

- Automatic fraud detection

Additional optional modules include:

- Automated Amortization

- NetSuite Native Amortization

- Advanced User Management

- NetSuite Custom Segments

- Advanced Approvals

- Purchase Orders

Jira Integration – Streamline Your Workflows

Jira Integration – Streamline Your Workflows  Ironclad Integration – Simplify Legal Operations

Ironclad Integration – Simplify Legal Operations  Asana

Asana