Airbase and Fountain: Financial Efficiency and Spend Management

Luke McKinlay

VP Finance

Blake Roper

Controller

Luke McKinlay, VP Finance at Fountain, credits Airbase with making it possible to control spend as the Workforce Management Software Company scaled rapidly across the globe. And in the process, Luke says “Airbase paid for itself tenfold.”

“Airbase is a finance tool meant for finance. It allows you to control spend, allocate it to the right places, and ensure maximum ROI on all purchases,” he says.

Our conversation with Luke and Blake Roper, Controller, revealed how Fountain uses Airbase to support a sophisticated financial operation.

- A streamlined process to control spend.

- Eliminated wasted spend.

- Better tools for international expansion and reporting.

- A more strategic role for finance.

The problem…

The solution…

The result…

The problem…

Various disconnected processes and systems for spending company money.

The solution…

Consolidate all spend — cards, invoices, and expense reimbursements — onto one platform.

The results…

Order out of chaos.

The problem…

Wasted and duplicate spend.

The solution…

Configurable approval workflows that flag duplication and require an ROI for any purchase.

The results…

Eliminated wasted spend.

The problem…

Lack of visibility into vendor contract renewals.

The solution…

Automated renewal planning that surfaces opportunities for better terms and cost savings.

The results…

More cost-effective vendor management.

The problem…

Time wasted on repetitive manual tasks.

The solution…

Automation of the full procure, pay, close cycle.

The results…

Time freed up for more valuable strategic work.

The challenge.

When Fountain first sought out a solution, it was an early-stage company undergoing rapid expansion. With growing amounts of spend occurring across departments, managing and centralizing financial processes become increasingly important. Luke described the problem:

“We were trying to corral spend and get it into one place. As a fast-growing startup, there was disparate spend happening all over. People had corporate credit cards and were putting all kinds of things on them that they shouldn’t. We were getting invoices signed from different places, and I was looking for a system to combine and organize the spend approval and corporate card management processes.”

Fountain’s finance team needed a comprehensive spend management solution that could scale with its growth. While their previous tool, Bill.com, handled some basic functions, it lacked the necessary spend controls and integration capabilities, such as a corporate card feature and an efficient spend approval process.

“Airbase offered the controls we needed, and it integrated with NetSuite, which was one of the selling points for me,” Luke shared.

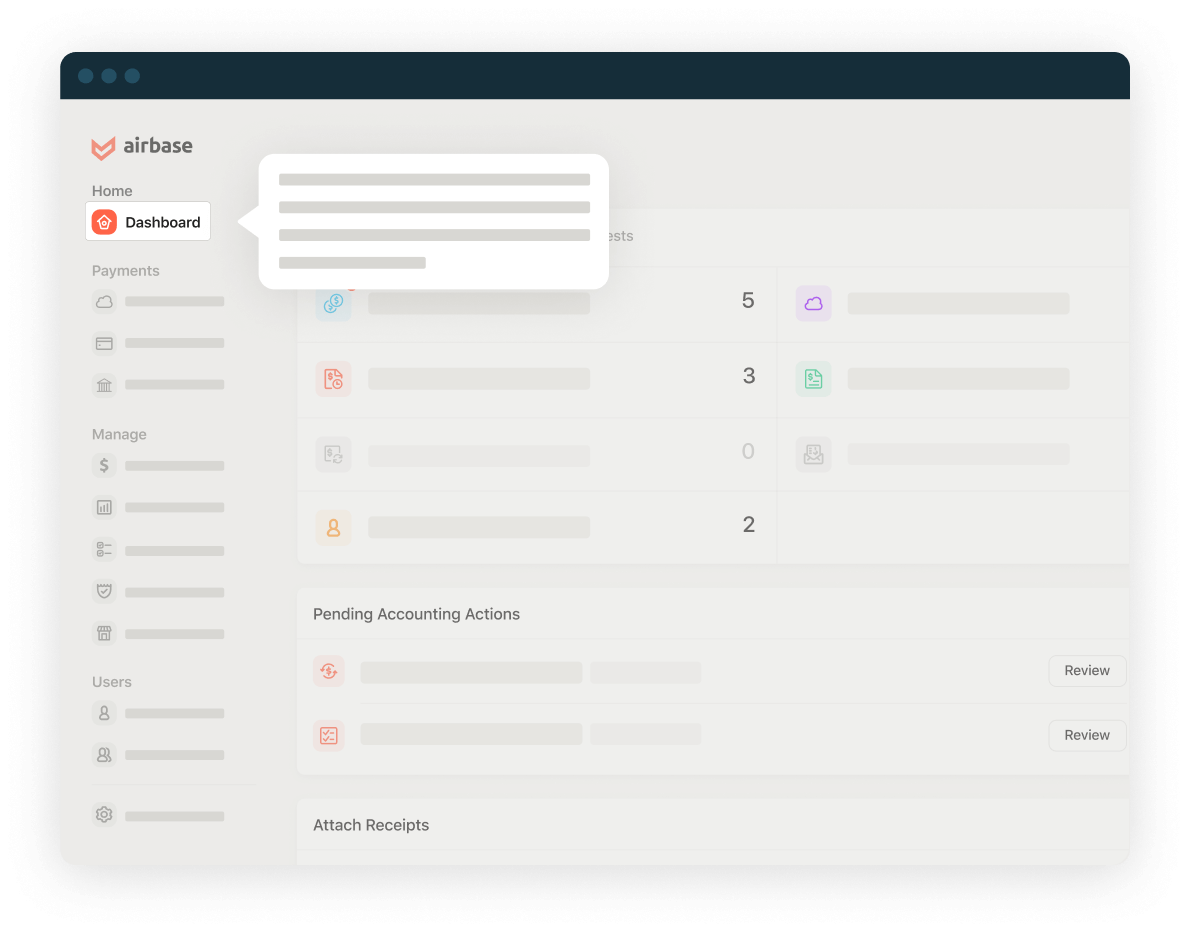

Implementation and integration.

Fountain’s finance team found the initial implementation of Airbase to be relatively seamless. Despite undergoing an ERP migration to NetSuite, integrating Airbase into their financial processes was smooth.

“We were able to just connect to NetSuite, and all of our chart of accounts, GL codes, departments, and classes synced over to Airbase. When invoices were approved, they synced back to NetSuite seamlessly, as did the virtual card spend,” Blake explained.

The finance team’s ability to connect all financial operations, streamline workflows, and maintain visibility over every dollar spent was transformative. With the synchronization between NetSuite and Airbase, there was a reduction in manual errors and a faster reconciliation process, which eased the pressure on the accounting team.

Implementation was also easy for non-finance teams like marketing. Luke explained that:

“Employees found the rollout seamless, with very little change management required. The level of disruption for employees was low, and the rapid adoption added to an accelerated time-to-value for Airbase’s software.”

Luke shared that other teams have also found additional efficiencies, such as using the AI feature to extract critical clauses from vendor contracts and supporting documentation like SOC reports.

Driving financial visibility and spend control.

One of the key benefits Fountain realized with Airbase was greater visibility and control over spend. Luke described the shift in how they managed vendor relationships and spending habits:

“Being able to go into Airbase and pull down reports by vendor showing monthly costs makes it so easy and clear — not just for the finance team, but for the spend owners in the company as well.”

Fountain’s finance team implemented regular evaluations of vendors and expenses every six months, using Airbase’s reporting features. This helped the company identify redundant spend and make informed decisions about canceling or renegotiating vendor contracts.

Luke emphasized that having detailed spend analytics in one place enabled the company to avoid wasteful spending, particularly on software subscriptions.

Renewals and vendor management.

The recent introduction of Airbase’s renewals feature provided additional support in managing vendor contracts and renewals. Luke noted:

“Having that renewals reminder is so helpful. It doesn’t exist in almost any other tool. We had kept spreadsheets over time, but they get out of date. Now, the process is systematized, ensuring that we don’t get caught by an auto-renewal if we don’t intend to.”

The renewals capability allowed the team to maintain control over contracts and prepare for renegotiations well in advance, avoiding unnecessary expenses due to auto-renewals.

Easier audits with Airbase.

Since implementing Airbase, the team has gone through audits, which have given them an appreciation for Airbase’s automated audit trail.

“The audit feature is really nice,” says Blake. “It pushes over a link to the exact transaction right to NetSuite. If you’re wondering what a transaction is, you can pull it up in Airbase and it takes you right to the link.”

Luke agrees. “It saves time from digging through transactions. It’s right there — boom! Here you go, auditor.”

Adopting a healthy spend culture.

Airbase’s spend management solution played a crucial role in establishing what Luke referred to as a “healthy spend culture” at Fountain. This has helped the company optimize budgets and maximize ROI on their spending.

Luke explained that Fountain differentiates between “on-the-court” and “off-the-court” spending. On-the-court spending refers to customer-facing activities that directly impact business growth, while off-the-court spending includes purchasing that does not directly contribute to revenue growth.

Luke has baked this concept into the spending process itself.

“It’s actually part of our Guided Procurement (Airbase’s intake module) workflow. We ask if the spend is on the court versus off the court, and then also what the expected ROI is on the spend.”

International expansion and multi-currency operations.

As Fountain expanded internationally, the ability to handle multi-currency transactions and international entities became critical.

“Airbase has given us a place where we can operate as an international, multi-currency business, even as a relatively small U.S.-based company with a small finance team. It’s given us a lot more leverage to expand internationally, maximize resources, and support our growth,” Luke shared.

The integration with NetSuite allowed Fountain to manage subsidiary payments, consolidating operations under one platform.

Results and outcomes.

The implementation of Airbase has delivered significant value to Fountain. The centralized spend control and visibility, improved vendor management, and streamlined international operations have all contributed to Fountain saving time and money.

“The pricing model is really fair, and the cash back is a nice benefit that makes the product an easy choice. We’ve been able to scale from around 50 people when we onboarded, all the way up to over 250 people worldwide today,” Luke said.

A better bottom line.

For Fountain, Airbase has been more than just a financial tool — it has become a critical part of their operational infrastructure, supporting their growth and providing clarity over financial decisions.

Fountain’s three-year journey with Airbase is a testament to how a well-integrated spend management platform can empower a finance team to drive organizational efficiency, promote a healthy spend culture, and support strategic growth.

Jira

Jira  Ironclad

Ironclad  Asana

Asana