Stampli was established in 2015 with the aim of eliminating manual tasks in AP processes by combining the power of AI and human intelligence.

While it has useful features, such as integrations with a wide number of ERPs and flexible corporate cards, some users complain about the lack of customization options, payment delays, and poor customer service.

This blog post includes a curated list of Stampli alternatives, each with unique features and pricing.

Comparison criteria.

Here are the criteria we have used to evaluate Stampli alternatives:

- The range and depth of features.

- User-friendliness.

- Pricing.

- Reviews and ratings.

Overview: Stampli alternatives and competitors.

| Competitor | Top Feature | Primary Market | G2 Rating | Pricing |

| Airbase | P2P | Mid-market and enterprises | 4.8 | $$ |

| BILL | Expenses | Small and mid-market companies | 4.7 | $$$ |

| Brex | AP Automation | Medium businesses and enterprises | 4.7 | $$ |

| MineralTree | AP Automation | Mid-Market | 4.2 | $$$ |

| Tipalti | AP Automation | Small to mid-market | 4.5 | $$$ |

| Yooz | AP Automation | Small to large businesses | 4.4 | $$ |

1. Airbase.

Automated intake process with customizable approval flows

With its advanced AP Automation and bill payment capabilities, Airbase is our top pick among Stampli alternatives.

While Stampli is limited to AP automation, bill payment, and cards, Airbase goes beyond to offer end-to-end spend management across Guided Procurement, AP Automation, Expense Management, and Corporate Cards modules.

Best features.

- Comprehensive P2P platform: Provides holistic procure, pay, close solutions that replace inefficient, siloed processes to accelerate time to value.

- Dynamic intake: Intake forms and approval flows dynamically adapt, capturing information needed for each milestone and keeping all stakeholders informed and aligned.

- Intelligent accounting automation: Accelerates bill creation and approvals, fast tracks month-end closing with PO matching, auto-categorization, amortizations, and reconciliation.

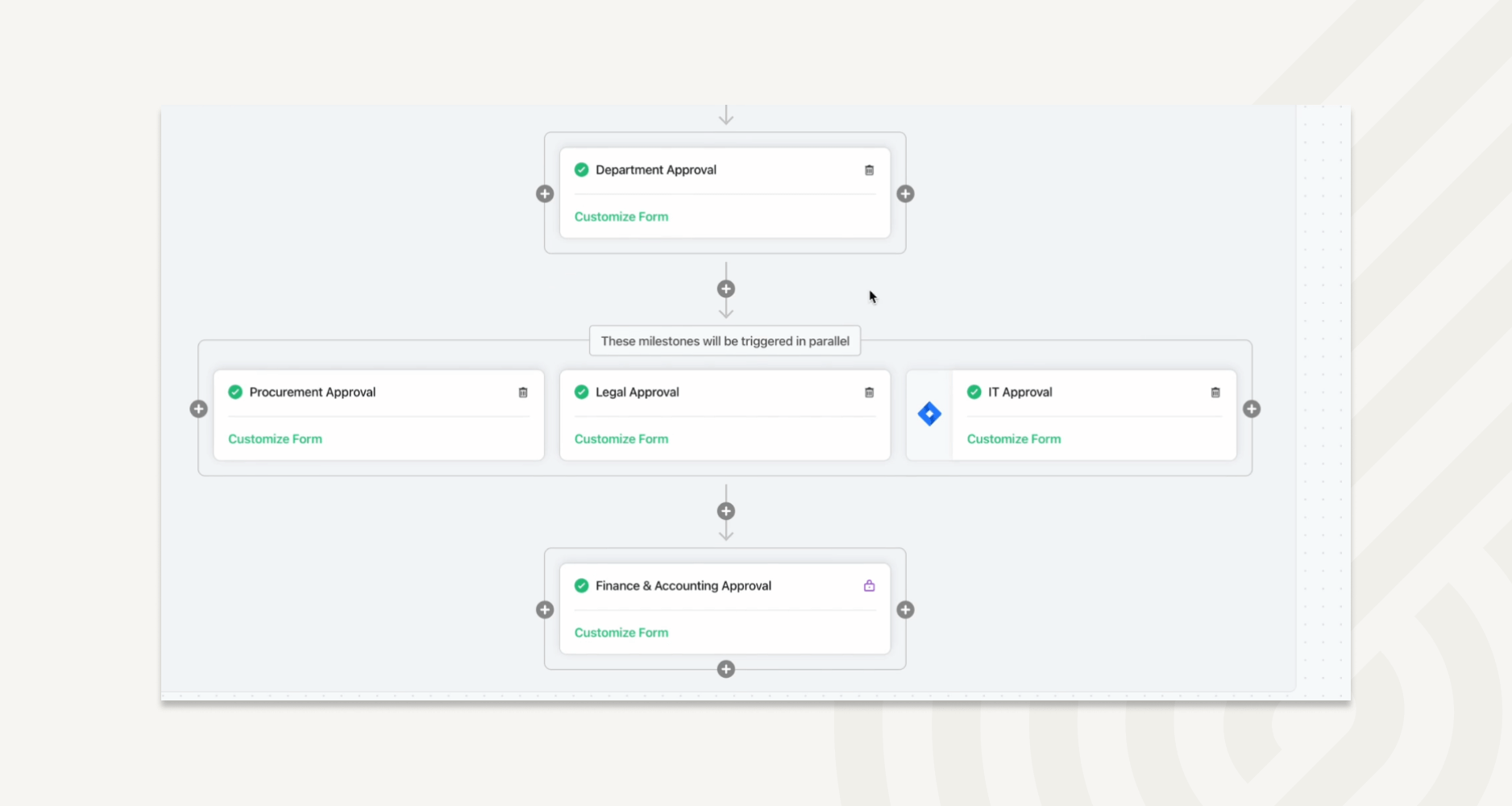

- Sophisticated approval workflows: Enables advanced approval workflows, including parallel and sequential flows, approval groups, and multi-layered flows.

- Generative AI-powered expense management: Utilizes AI-powered OCR and machine learning to automate expense report creation, categorization, and policy enforcement.

- Versatile bill payment capabilities: Simplifies payments with direct payment options, international payment support, and the ability to link multiple bank accounts to subsidiaries.

- Extensive integrations: Provides native and custom integrations with major GLs, over 70 ERPs, HRIS, and popular tech stacks.

Airbase G2 rating: 4.8/5

Airbase pricing.

Airbase offers three packages: Standard, Premium, and Enterprise. All the packages include key platform features while optional add-ons are available for travel, purchase orders, and approval workflows. Users can also opt for individual modules instead of the whole platform.

Customers and best suited for:

- Company size: Mid-market to large enterprises (with 50 to 10,000 employees).

- Solution needs: Businesses looking for a scalable solution for Guided Procurement, Account Payable Automation, Expense Management, and Corporate Cards, and those seeking an all-in-one procure, pay, close solution by adopting the full suite.

Take a tour of Airbase.

Explore Airbase with a self-guided tour.

2. BILL.

Customizable dashboard to view accounts payable tasks

BILL (formerly Bill.com) automates accounts payable, accounts receivable (AR), and expense management tasks for small and mid-market companies. In addition, BILL offers a database of over 4 million vendors, cash flow forecasting, budgeting, and cross-border payment support.

Best features.

- AP dashboard: The accounts payable dashboard gives an overview of invoices, approvals, payments, and the most urgent tasks.

- Invoice automation: OCR technology parses invoices and AI-powered Smart Data populates data from previous bills, including departments, payment terms, items, etc.

- AI-powered expense reporting: The Spend & Expense module uses AI to extract data, automate expense reports, and categorize transactions on purchases made via BILL corporate card.

- Global payments: Users can pay vendors in the BILL Network (a database of over 4 million vendors) in USD and in 106 currencies across 130 countries.

BILL G2 rating: 4.2/5

BILL pricing.

BILL’s Spend & Expense module is free to use. The Accounts Payable & Receivable module offers four packages — Essentials ($45 per user per month), Team ($55 per user per month), Corporate ($79 per user per month), and Enterprise (custom pricing). The top-tier plans offer custom approval flows and automatic 2-way syncing with accounting systems.

Customers and best suited for:

- Company size: Small and mid-market companies.

- Solution needs: Businesses looking for an integrated platform to manage expenses, accounts payable, and accounts receivable.

3. Brex.

Card control center to manage cards and spend limits

Brex, one of the well-known Stampli alternatives, uses AI to automate AP and expense management processes for businesses of all sizes. With Brex, companies can issue corporate cards, open a business bank account, and book compliant travel.

Best features.

- AI-powered AP automation: Suggests GL coding and accounting rules, spots anomalies, and syncs transactions to accounting systems.

- Expense management: Brex Assistant provides instant answers to employees, automates receipt capture, auto-generates memos, and populates fields.

- Custom approval policies: Admins can define budgets for departments and create approval policies for departments, entities, use cases, and other criteria while reimbursing employees within the U.S. and in 70 countries.

- Corporate cards: Admins can issue virtual and physical cards with customized spend limits from within the card control center.

- Travel tools: Access to a global inventory of hotels, flights, and car rentals, tools to manage group bookings, exclusive deals, and live agent support.

Brex G2 rating: 4.7/5.

Brex pricing.

Brex offers three packages — Essentials (free), Premium ($12 per user per month), and Enterprise (custom pricing). The free plan offers basic features, such as global corporate cards, AI assistant, bill pay, and expense management. For advanced features, such as global payments, in-app travel booking, custom policies, and approval flows, you’ll need to upgrade to one of the paid plans.

Customers and best suited for:

- Company size: Startups, medium businesses, and enterprises.

- Solution needs: Companies who want an expense management platform with basic AP automation and procurement features.

4. MineralTree.

An additional layer of human review to minimize invoice errors

As one of the suitable alternatives to Stampli, MineralTree provides similar features across AP automation and bill payment. Like Stampli, MineralTree offers integrations with 100+ ERPs and a virtual card with rebates. However, MineralTree lacks vendor management capabilities that Stampli offers.

Best features.

- Smart AP automation: Captures and automatically codes invoice data, carries out PO matching, and syncs transactions to GL or ERP.

- Advanced approval workflows: Enables custom approval workflows based on multiple attributes and automates reminders to fast-track approvals.

- Managed payments: Offers payment support with a dedicated team to minimize transaction costs.

- Real-time dashboards: Displays insights on key areas, including payment mix, cash flow, and AP process.

- Secure virtual card: Offers virtual cards that can be pre-loaded with specified amounts based on established vendor agreements.

MineralTree G2 rating: 4.2/5

MineralTree pricing.

MineralTree’s charges are based on payment and invoice volume. There are also one-time onboarding and training costs involved.

Customers and best suited for:

- Company size: Mid-market companies and enterprises.

- Solution needs: Businesses that are looking for AP automation and analytics.

5. Tipalti.

Centralized invoice management within Tipalti Hub

Tipalti handles accounts payable automation for mid-market and enterprise companies. The platform also has e-procurement, bill payment, and expense management capabilities.

Another area where Tipalti goes beyond Stampli is by offering a white-label portal that integrates with performance management systems to manage payments to affiliates and partners.

Best features.

- Invoice automation: OCR, smart logic and ML-based invoice data extraction, bill data prediction, approval routing, and bill level coding.

- Collaboration tools: Built-in messaging app and automated notifications to suppliers on invoice and payment status.

- Invoice grouping: The ability to hold specific invoices for later payment, group invoices for batch payments, and automatic withholding of payments when funds are inadequate.

- Procurement tools: Customizable intake forms, PO creation, a centralized contract repository, contract approval flows, and integrations with ticketing systems.

Tipalti G2 rating: 4.5/5

Tipalti pricing.

Tipalti offers two modules — the AP Automation and Procurement module and Mass Payments.

The AP Automation module has three packages, with the Starter plan priced at $129 per month, while the Premium and Elite plans offer custom pricing.

The Mass Payments module has two packages (Accelerate and Plus) both of which have custom pricing.

Customers and best suited for:

- Company size: Mid-market and enterprise companies.

- Solution needs: Companies that need basic procurement, AP automation, and expense management solutions.

6. Yooz.

Invoices can be sent via multiple channels

If you are on the lookout for easy-to-use Stampli competitors with AP automation capabilities, Yooz may be a candidate.

In addition to batch invoice management, Yooz leverages ML, AI, and big data, to automate GL coding, PO matching, and invoice processing across a network of vendors.

Best features.

- Invoice capturing: Offers multiple ways to capture invoices, POs, and other documents including email, imports, mobile uploads, bulk uploads.

- PO automation: Makes it easy for employees to create purchase requests while generating POs upon approval.

- Automated coding: Leverages ML, AI, and big data to automate GL coding and PO matching across a network of vendors.

- Custom approval flow: Enables admins to set up approval flows or employees can select an approver from a dropdown list.

- Payment system: Allows users to approve and make payments using YoozPay, while payments get updated on the ERP system.

- Document segregation: Differentiates batches of invoices and prevents their duplication with YoozStamp.

Yooz Payments G2 rating: 4.4/5.

Yooz Payments pricing.

Yooz offers a free 15-day trial. The paid plan, Gold Edition, is priced based on the number of documents processed.

Customers and best suited for:

- Company size: Small to large businesses.

- Solution needs: Companies looking for a simplified AP automation platform in addition to automatic segregation of documents.

Make bulk payments via multiple payment methods

MineralTree is one of the suitable alternatives to Divvy for businesses that prioritize AP automation. MineralTree differentiates itself from BILL with integrations to a plethora of ERPs.

Best features.

Smart AP automation: Captures and automatically codes invoice data, carries out PO matching, and syncs transactions to GL or ERP.

Advanced approval workflows: Enables custom approval workflows based on multiple attributes and automates reminders to fast-track approvals.

Managed payments: Offers payment support with a dedicated team to minimize transaction cost.

Real-time dashboards: Displays insights on key areas, including payment mix, cash flow, and AP process.

Secure virtual card: Offers virtual cards that can be pre-loaded with specified amounts based on established vendor agreements.

Mineraltree G2 rating: 4.2/5

MineralTree pricing.

MineralTree charges a licensing fee in addition to transaction fees and fees based on payment and invoice volume.

Customers and best suited for:

- Company size: Mid-market companies and enterprises.

- Solution needs: Businesses that are looking for AP automation and analytics.

Airbase vs Stampli.

Moving on to our head-to-head Stampli vs Airbase comparison, we’ll closely examine the strengths and features of each platform.

What does Airbase do?

Airbase is a leader when it comes to spend orchestration with advanced capabilities across AP automation, procurement, and expense management.

Airbase wins over Stampli with its customizable virtual cards, physical cards, and granular reporting capabilities. While Stampli allows payment to vendors across 100+ countries, Airbase enables international payment across 200 countries in 145+ currencies.

The other differentiators include the services of a dedicated fraud investigation team that works 24/7 to flag potentially fraudulent transactions, industry-leading cashback program, and comprehensive procurement solutions.

Airbase solutions.

Guided Procurement.

A no-code builder to create custom approval workflows

When it comes to procurement automation (a feature that Stampli lacks), Airbase outperforms Stampli alternatives that offer procurement solutions. The Guided Procurement module simplifies the P2P process by eliminating the need for multiple systems. Its intelligent automation and conditional logic combine to offer step-by-step guidance for creating compliant purchase requests.

Unlike most other Stampli alternatives, Airbase dynamically updates approval workflows and forms based on user responses. Admins can create custom workflows with a no-code builder, gaining full visibility and control over the purchasing process. Approvers can review and approve requests within systems like Jira, Slack, and Ironclad that integrate with Airbase.

Similar to Stampli, Airbase provides vendor management tools, including a centralized platform for managing vendor details and a self-service portal for vendors.

Accounts Payable Automation.

Airbase supports multiple bill payment methods

Airbase’s AP automation capabilities are far more advanced compared to Stampli. With advanced approval flows, 3-way PO matching, and automated reconciliation, Airbase optimizes every step of the AP process to speed up month-end close.

Admins can create intricate approval workflows with approval groups, parallel or sequential flows, and contingencies for automatic rerouting. Unlike Stampli, Airbase supports accruals, payment runs, and bill amortization.

Payments to vendors in 200+ countries and 145+ currencies are supported through multiple payment methods, including virtual cards, wire transfers, domestic and international ACH, and checks.

Airbase also offers robust multi-subsidiary support, another feature that’s missing in Stampli. Companies can link each subsidiary to its own bank account and GL, and assign a default subsidiary to each user.

Airbase automatically makes payments from the specified account, assigning cards, bill payments, and reimbursement transactions to the relevant subsidiary.

Expense Management.

Generative AI auto-populates fields to fast-track expense reports

Airbase takes a centralized approach to spend management with its comprehensive Expense Management module. This module integrates with corporate cards, ERP systems, and the travel booking platform to provide a consolidated view of spend and automate reconciliation.

Unlike Stampli, Airbase uses advanced OCR, ML, and generative AI to capture receipts, extract data, automate expense reports, categorize expenses intelligently, and flag policy violations. The platform automatically populates categories and tags to simplify spend requests.

Corporate Cards.

Physical cards can be issued to employees in 180+ countries

Airbase’s Corporate Card program stands out from similar offerings from Stampli and its competitors. For starters, Airbase offers direct cash back of up to 2% on every transaction, a feature that most Stampli alternatives lack.

Unlike Stampli, Airbase allows the creation of unlimited virtual and physical cards and enables partner card integrations for AMEX and SVB. Airbase seamlessly synchronizes card transactions via deep integrations with NetSuite and 70+ ERPs.

What does Stampli do?

Stampli is an accounts payable automation software with integrated payments and expense management solutions. Billy the Bot, Stampli’s AI co-pilot automates AP tasks such as capture, coding, routing, and fraud detection.

As Stampli integrates with 70+ ERP systems, businesses can upgrade their AP processes without overhauling their current ERP systems.

By consolidating documents, vendor communication, AP workflows, and bill payments into a single platform, Stampli provides visibility and control over AP processes.

Accounts Payable.

Billy the Bot automates invoice coding and approval routing

Stampli’s AI co-pilot, Billy the Bot, automates accounts payable tasks, capturing invoice data, coding, matching invoices to POs, routing to the right approvers, and flagging duplicate invoices. Stampli supports multiple invoice formats, such as PDF, JPG, PNG, and DOCX and can split multi-page invoices as needed.

A mobile app, built-in messaging feature on the web portal, and a centralized view of invoices makes it easy for approvers to review relevant details and collaborate with team members.

Stampli offers pre-defined approval flows with a workflow builder to add specific fields and assign approvers based on amount, vendor, department, company, and custom fields.

Alternatively, you can use Billy the Bot to create dynamic workflows with the AI tool, adapting to suggestions and typical workflows.

However, you can use either pre-defined or dynamic workflows. Stampli doesn’t allow setting of workflows on an individual invoice basis.

Vendor management.

Customizable vendor onboarding settings

Stampli’s vendor management module integrates with the AP automation platform to streamline vendor onboarding and communication.

You can create any number of onboarding forms specific to each vendor to ensure you have all the documents and information available in the portal, including bank account, preferred payment methods, licenses, W-9s, and insurance. It’s also possible to create branded email invites and log-in pages. Vendors can directly upload their invoices and track payment status within the portal.

Payments.

Domestic payments can be made via checks, ACH, and credit cards

The Direct Pay module handles bill payments, payment approvals, and reconciliation by integrating with cards, AP automation software, and ERP systems.

Domestic payments can be made via ACH, credit card, and check and the platform presents a consolidated view of invoices, payment activity, and other details on a single screen.

Companies can make international payments in local currencies in 100+ countries. Stampli allows users to set target foreign exchange (FX) rates and use the built-in FX rate tools to automate payments when the target is met.

Detailed remittance emails are sent for each payment, maintaining transparency and a clear audit trail.

Corporate cards.

Admins can issue single-use, multi-use, or recurring virtual cards

Stampli offers AP Cards for finance teams and Expense Cards for employees. AP Cards integrate with the AP Automation platform and card transactions sync with the invoice processing workflows. Admins can set spend limits and restrict the usage of AP Cards to certain categories or vendors.

Expense Cards can be issued for single-use or multiple purchases. The spend limits on these cards can be set to expire or be refreshed on a defined cycle.

Unlike Airbase, Stampli does not automate expense reports using OCR and generative AI. However, the platform allows employees to upload images of receipts, store them in the Receipt Library, and access them to create expense reports.

In summary.

As you can see, Stampli competitors are not created equal. Some lack the range and depth of features that growth-oriented businesses seek while others have a complicated pricing structure. Stampli’s offerings are limited to AP automation, vendor management, and corporate cards.

But, if you’re looking for the best of both worlds — mature procure, pay, close capabilities and an affordable pricing structure — Airbase is the right choice.

With Airbase, businesses can achieve greater financial control and visibility, leading to better decision-making and improved financial health.

Studies show that Airbase accelerates time to value, delivering an impressive ROI of 272% by maximizing compliance, eliminating manual tasks, saving labor costs, and replacing point solutions.

The platform has consistently earned top rankings on G2 for its innovativeness, responsive customer service, and intuitive user interface.

A powerful combination of features, affordability, and user satisfaction makes Airbase a top contender for businesses looking to transform their financial processes.

Jira Integration – Streamline Your Workflows

Jira Integration – Streamline Your Workflows  Ironclad Integration – Simplify Legal Operations

Ironclad Integration – Simplify Legal Operations  Asana

Asana