Purchase order vs invoice: knowing the differences between the two — and the best practices for each — will improve efficiency and control over company spending.

Let’s examine the difference between a purchase order and an invoice, and the prime considerations for when to use them.

Key differences between purchase orders and invoices.

The main differences between purchase orders and invoices are in their origin and purpose.

Here are the key distinctions.

Purchase order (PO):

- Issued by the buyer before the transaction takes place.

- Formalizes the purchase agreement.

- Helps track and manage a purchase.

Invoice:

- Issued by the vendor after a purchase order is fulfilled.

- Requests payment, including payment terms and deadlines.

- Itemizes the details of a transaction.

What comes first — the invoice or purchase order?

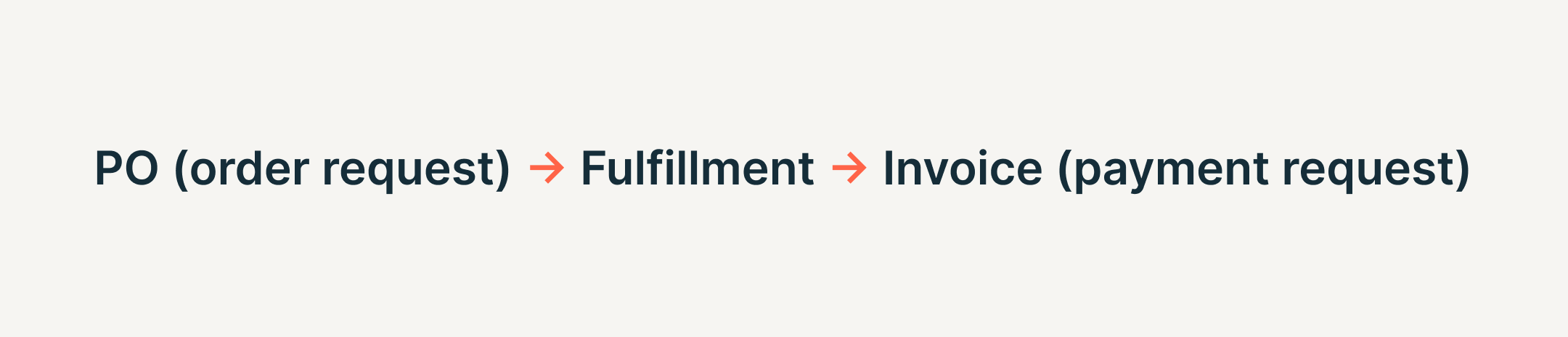

The purchase order comes first. A purchase order is raised by the buyer in order to request goods and/or services.

Once the order is complete, the vendor sends an invoice to request payment.

What is a purchase order?

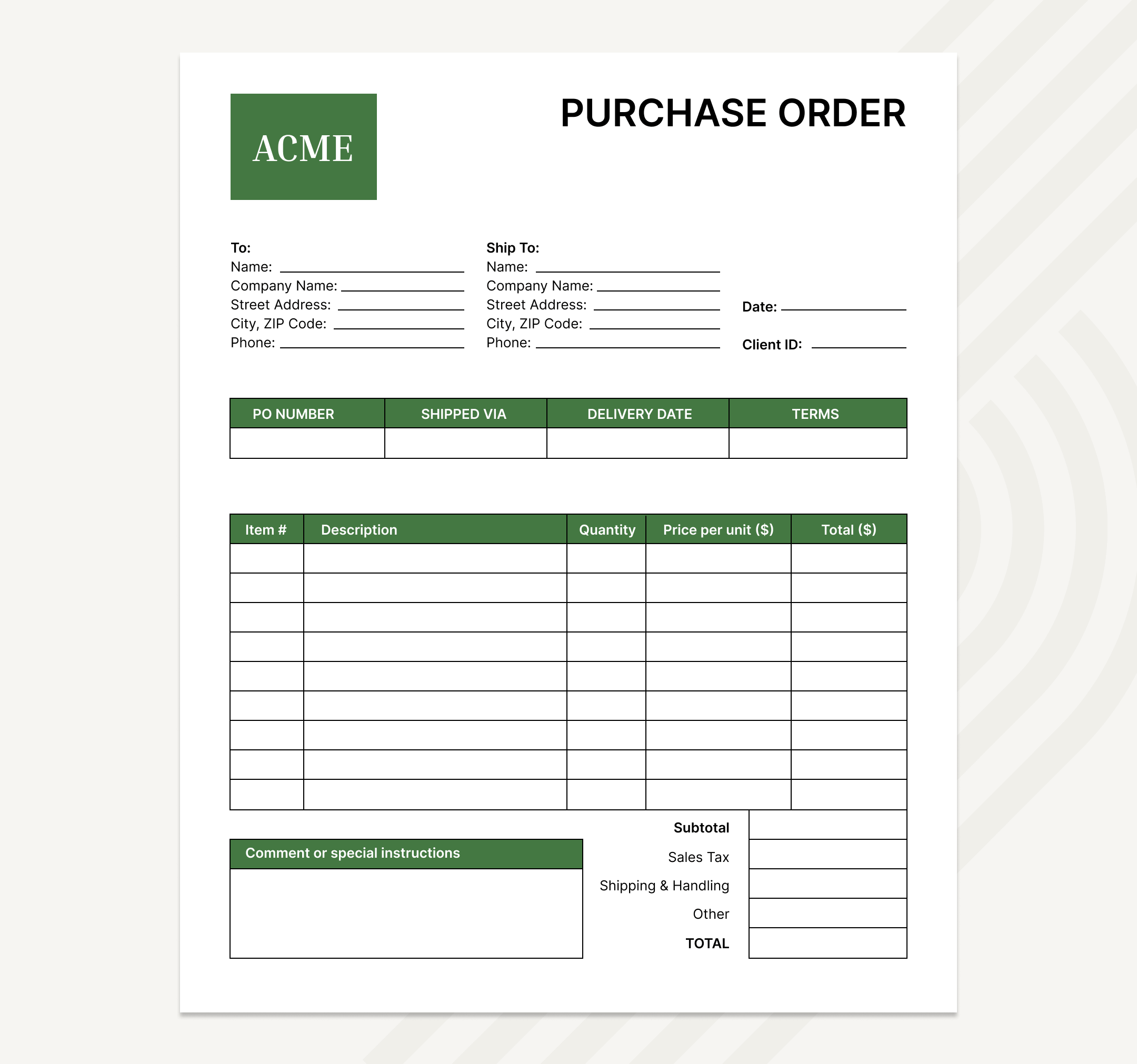

A purchase order is a formal document created by a purchaser for a vendor. It is a legally binding document that outlines the key components of a purchase, including quantities, delivery dates, and payment terms, and ensures both parties are clear on the terms of a transaction.

The exact format of a purchase order varies, but typically they contain:

- A PO number for tracking.

- The date the PO was raised.

- The vendor’s contact details and address.

- Order details, including SKU and quantity if applicable.

- Delivery methods, if applicable.

- Payment terms.

With the right processes in place, purchase orders can play an important role in managing purchasing and controlling spend.

What is the purpose of a purchase order?

POs enhance efficiency and reduce risk, particularly in organizations with complex purchasing needs. They do this by clearly documenting expectations, which helps to prevent misunderstandings between buyers and vendors. Since the agreed-upon terms and conditions of the transaction are clearly outlined, there are fewer errors.

POs also offer spend control by helping track budgets and prevent unauthorized purchases. By requiring that purchases be clearly documented and approved before orders are placed, POs prevent unauthorized or unnecessary purchasing, adding an extra safeguard for budget control.

As a clear record of purchasing decisions, POs create a thorough audit trail, which is a key component of both compliance and strategic decision-making.

Because they’re legally binding, they also offer protection as a formal document easily referenced in a dispute.

What is an invoice?

An invoice is a document issued by a vendor to a purchaser, outlining the terms of a transaction.

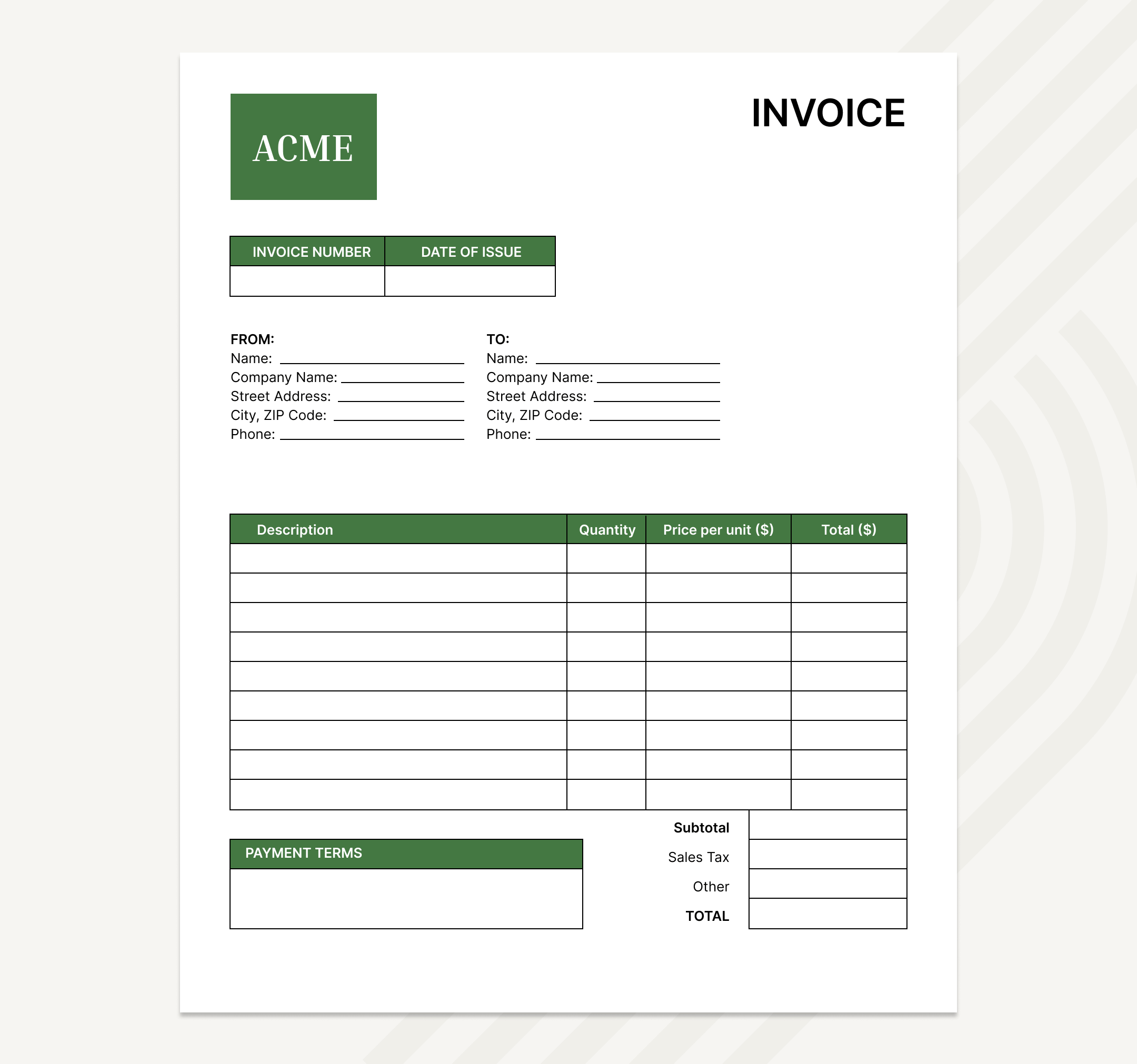

Some common parts of an invoice include:

- Invoice number for identification.

- Invoice date.

- Payment date, showing the date the payment is due.

- Detailed description of the goods or services purchased and their prices.

- Total amount due.

- Payment terms.

- Tax details.

- Payment instructions showing how the buyer can make the payment.

Invoices are a crucial component of managing spend, as they track purchases and ensure that payments are made on time, which in turn helps to manage cash flow.

Why are purchase orders and invoices important for accounting?

Purchase orders help organizations to track purchasing against budget, making it easier to manage cash flow and avoid overspending.

Invoices clearly document the details of a transaction and help with prompt payment tracking, helping finance teams to make timely payments and avoid late fees or disruptions in service.

This chain of documentation ensures that all financial decisions are properly recorded, making it easier to track spending, resolve disputes, and comply with audits.

When an invoice is matched to the corresponding purchase order, accounting teams can identify discrepancies in price or amount. This ensures that they’re only paying for exactly what was received.

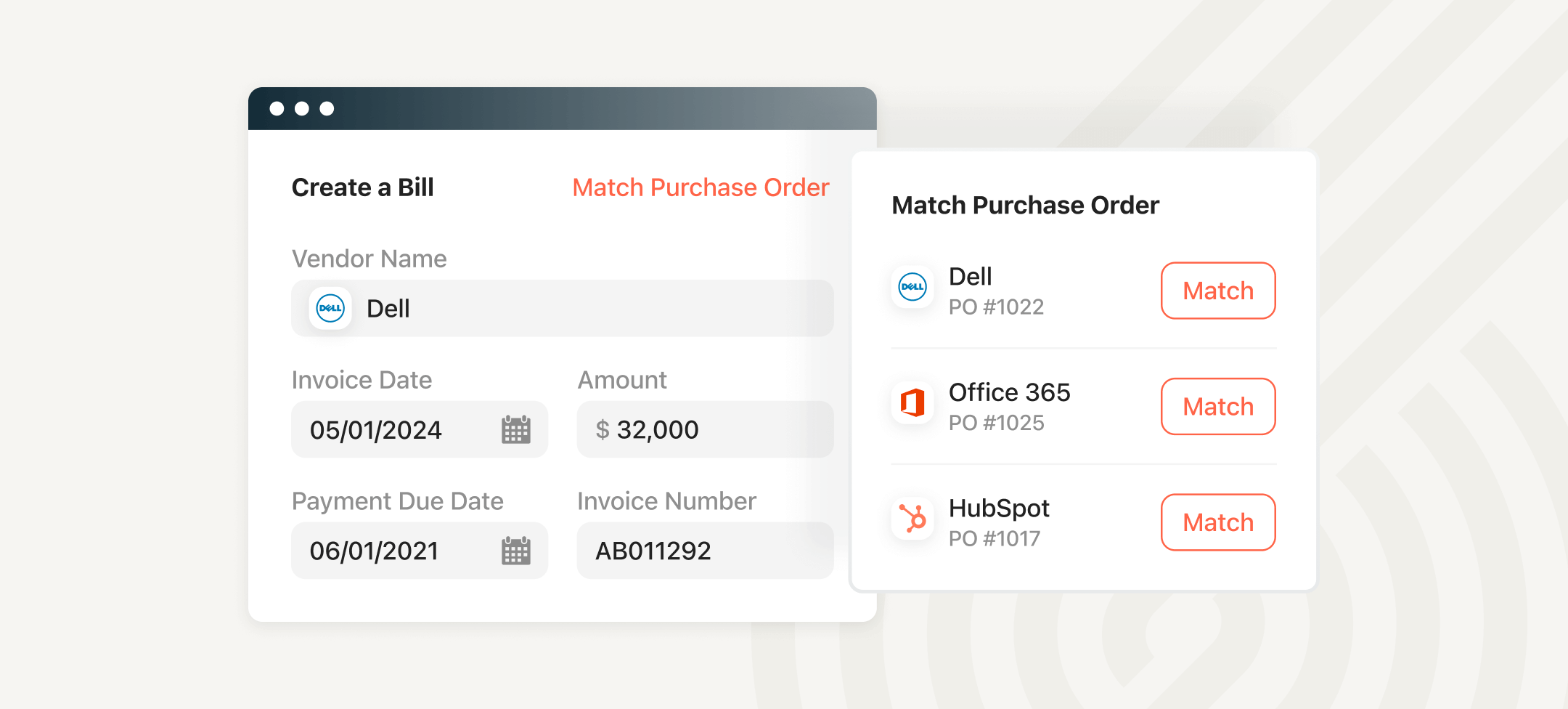

There are two types of PO matching:

- 2-way match: Matches the invoice with the PO. This is more comment for simple, low-volume purchases.

- 3-way match: Matches the PO with the invoice and the receipt or packing slip. This helps verify that more complex purchases are correct before the invoice is paid.

Invoice vs purchase order template examples.

Here’s a purchase order template showing the common elements of a PO:

Here’s an invoice template:

Common misconceptions about purchase orders and invoices.

Are they interchangeable?

No, purchase orders and invoices are not interchangeable. That’s because they serve distinct purposes. But, it’s easy to confuse them because they often reference the same transaction and contain overlapping details, like product descriptions and prices. Their timing, purpose, and issuers are different — although both have the ultimate goals of controlling spend, reducing errors, and improving compliance.

Think of the lifecycle of a transaction as:

Using both POs and invoices ensures smooth procurement processes, reduces errors, and keeps financial operations in sync.

Invoices vs POs vs receipts vs sales orders — what’s the difference?

These terms are easily confused. Let’s break each of them down a bit to understand the difference.

- Purchase Orders: Raised by the purchaser to confirm an order.

- Invoices: Sent by the seller once the transaction is complete in order to request payment

- Sales Orders: A document from the vendor confirming the purchaser’s order before invoicing.

Can you invoice without a purchase order?

Yes, you can invoice without a purchase order. In fact, it’s a common practice in many scenarios, although it is important to assess the risks in each situation.

Some situations where a PO may not be necessary include:

- Small businesses or freelancers who operate without a formal procurement system in place and often make verbal agreements. In those cases, an invoice may be the first document for a transaction.

- Subscription-based services don’t always require a PO.

- Emergency or rush orders may skip a PO to expedite a purchase.

- Many companies may not require a PO for low-value purchases.

However, without a PO you could also face several risks:

- You don’t have a pre-approved agreement on the terms of a transaction, which could potentially lead to disputes with the vendor.

- Because POs track committed spending, without them organizations run the risk of going over budget.

- It’s easier for fraud or unauthorized transactions to slip through without a PO.

- Invoices without a corresponding PO can raise questions during an audit.

If your business often bypasses POs, it’s important to have safeguards in place to minimize those risks.

Approval workflows that vet all spend requests before a purchase is made add that important layer of control.

Best practices for managing purchase orders and invoices.

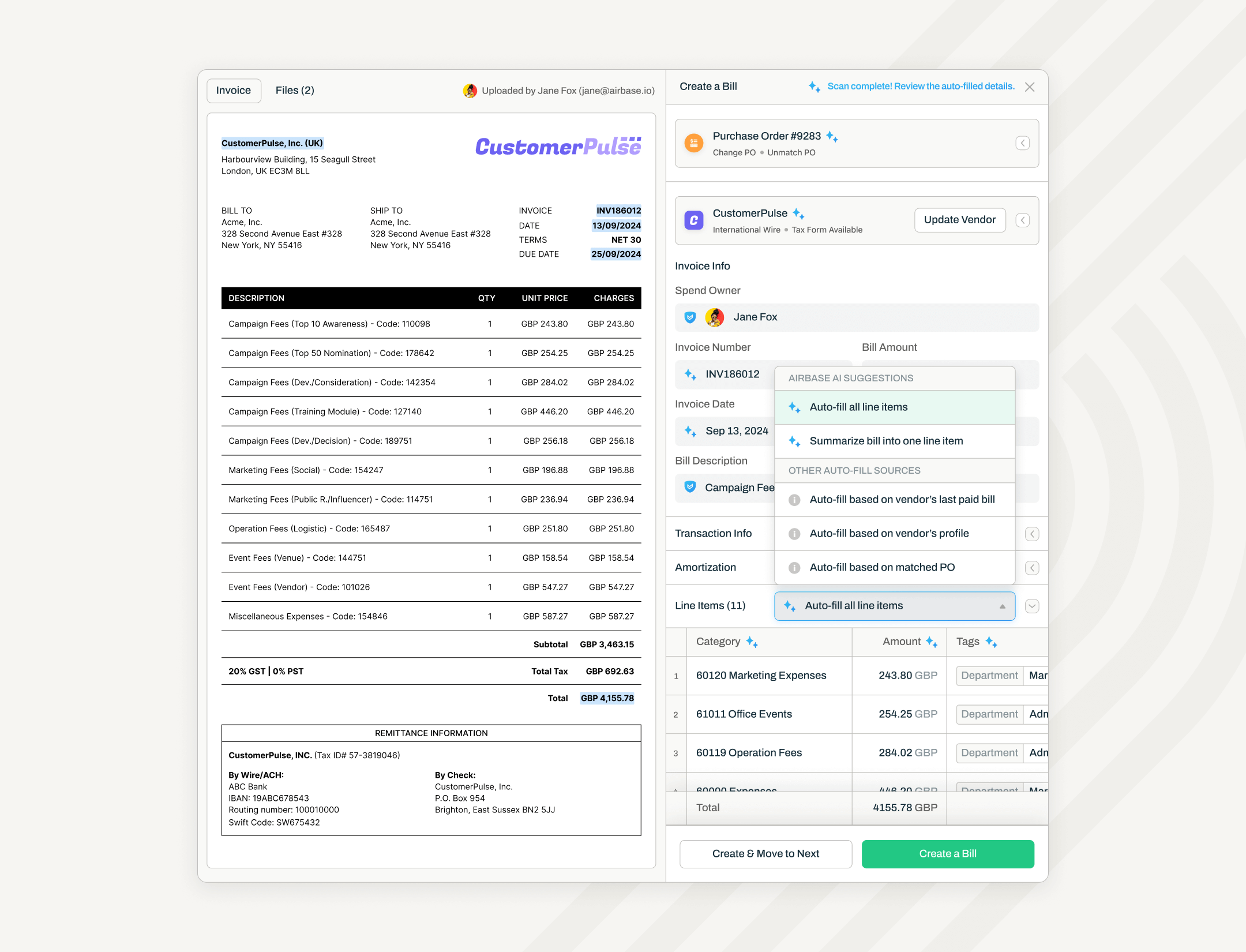

Automated accounts payable platforms make it easy to manage purchase orders and invoices. The best accounting software leverages configurable workflows to ensure all POs are approved by the appropriate stakeholders.

Here’s how it works in Airbase.

Requesting a PO is easy and follows the same intuitive workflow as all spend requests. From there, a PO is routed to the appropriate approvers. It can also be routed to observers to keep them in the loop, even if their approval isn’t required.

Once a PO is raised, Airbase creates a transaction record with all relevant information for an automatic audit trail.

Invoice processing is easy thanks to OCR technology that captures the details and creates a bill that is matched. Automated two- and three-way matching ensures orders invoices are correct before they’re paid.

See the purchase order vs invoice for yourself. Book an Airbase demo!

Jira Integration – Streamline Your Workflows

Jira Integration – Streamline Your Workflows  Ironclad Integration – Simplify Legal Operations

Ironclad Integration – Simplify Legal Operations  Asana

Asana