Continuous accounting has the power to change a company — not just its financial operations. On the surface, continuous accounting is simple: A process through which accounting tasks take place in real time, or continuously, so that the books are updated as transactions take place. An obvious benefit is that the accounting workload is therefore consistent throughout the month, which streamlines the traditional — and much dreaded — month-end close. Finance teams appreciate that they don’t have to put in those long hours every month, but the implications are deeper and can ultimately impact the way a company makes strategic decisions in all aspects of a business.

1. No more manual work.

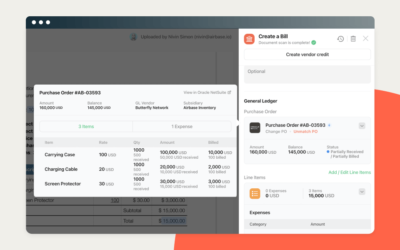

Continuous accounting relies on automated accounting processes for gathering data and syncing it to the general ledger in real time. A noted benefit of these processes is the ability to automatically create an audit trail of each transaction by making it possible to add contracts, invoices, receipts, and other documentation right into the transaction record. When backed by powerful software, corporate credit card activity is easily tracked and controlled, without having to reconcile credit card statements or upload CSV files.

This eliminates hours of boring, repetitive work. Airbase’s Annual Benchmark Survey asked 745 finance and accounting professionals how much time they spend on manual tasks. For 38% of respondents, the answer was more than 25% of their time. The irony is that most manual work is completely unnecessary given today’s technology — in fact, an IBM report states that accounts payable is the most automatable business process. As anyone who has spent hours copying data likely knows, repetitive manual work is more prone to error. Because it is powered by automated processes, continuous accounting eliminates that risk.

2. Better access to data for decision-making.

A truly continuous close, in which the books are balanced and reconciled at any given moment, may be more aspirational than realistic. But when reconciliations and allocations happen regularly, a “soft close” is possible with little effort, and the actual monthly close becomes much simpler. That’s another significant time saving: Airbase’s Benchmark Survey found that 61% of respondents take at least one week to close, and 18% take more than two weeks.

But the time savings extend beyond the finance team. When finances are updated in real time, decision-makers and budget owners don’t have to spend time creating ad hoc reports, or making adjustments to accommodate out-of-date data in decision-making. Everyone is working with current financial data, streamlining the process of examining results. Even if a full stack continuous close isn’t possible, it’s often possible with key metrics like bookings.

3. Spend culture to support rapid, safe deployment of capital to support company activities.

When activities are planned based on current financial data, that data can play a more important role in shaping actions and policies. Financial key performance indicators are readily available, in real time, which enables more agile decisions. When this happens, the sources of financial information become increasingly valuable in providing actionable data. Product and marketing strategies can become more proactive, as opposed to reacting to events from a few weeks ago. Continuous accounting makes it easier to see the interconnections between those systems and, ultimately, the connections between all departments in a company.

Strategic finance professionals have long struggled to obtain data as close to real time as possible to track what’s working and what’s not working, but continuous accounting wasn’t possible with traditional siloed tech stacks (one system for bills, another one for reimbursements, etc.). Waiting for credit card statements further slowed the process. Spend management platforms with integrations to an accounting system or ERP are the solutions they have been waiting for.

Schedule a demo to find out how Airbase helps companies move towards continuous accounting.

Jira Integration – Streamline Your Workflows

Jira Integration – Streamline Your Workflows  Ironclad Integration – Simplify Legal Operations

Ironclad Integration – Simplify Legal Operations  Asana

Asana