Since SAP acquired Concur Technologies in 2014, it has retained its focus on offering travel and expense (T&E) management. While it later added AP automation and payment solutions, several competitors are challenging the status quo of SAP Concur in the realm of travel and expense management.

Comparison criteria.

When evaluating Concur alternatives, it’s important to focus on key criteria, such as,

- The software’s features.

- User interface.

- Pricing structure.

- Reviews and ratings.

Overview: Concur alternatives and competitors.

| Competitor | Top Feature | Primary Market | G2 Rating | Pricing |

| Airbase | P2P | Mid-market | 4.8 | $$ |

| Mesh Payments | Expenses | Small to mid-market | 4.6 | $$ |

| Alaan | Expenses | Startup to enterprise | 4.7 | $$$ |

| Pleo | Expenses | Startup to mid-market | 4.7 | $$ |

| Paycom | Expenses | Small to large businesses | 4.2 | $$$ |

| Emburse Certified Expense | Expenses | Small to mid-market | 4.3 | $$ |

| Fyle | Expenses | Small to large businesses | 4.2 | $$$ |

| Center | Expenses | Small to large businesses | 4.2 | $$ |

| Navan | Expenses | Small to large businesses | 4.7 | $$ |

| Zoho Expenses | Expenses | Small to large businesses | 4.7 | $$ |

1. Airbase.

Positioned as one of the top Concur alternatives, Airbase provides holistic solutions for accounting professionals and businesses spanning Guided Procurement, Accounts Payable Automation, Expense Management, and Corporate Cards.

SAP Concur, on the other hand, has historically focused on travel and expense management with invoicing and AP automation as later additions.

Airbase has an integration with TravelPerk to tie travel booking into Airbase’s robust approval workflows and its superior ERP integrations.

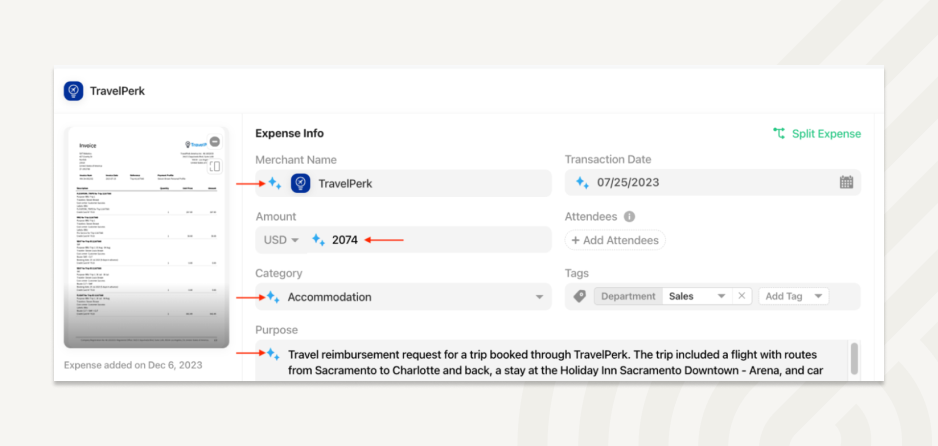

Airbase AI automatically populates data from the uploaded receipt

Best features.

- AI-powered expense reporting: Airbase takes expense reporting to a new level with its touchless expense reporting capability. Take a picture of a receipt and Airbase does the rest.

- Procure, pay, close: Airbase incorporates Expense Management into the full suite for all spend. Fast-tracks the procurement, payment, and closing processes with automated workflows, seamless ERP integration, and direct payment support.

- Flexible corporate cards program: Offers the capability to issue virtual and physical cards, provides amortization for cards, and supports multi-currency transactions with spend controls.

- Vendor management tools: Provides a dedicated vendor portal and tools for managing vendor relationships and transactions efficiently.

- Comprehensive expense management: Optimizes spend management efficiency with pre-approved corporate cards, OCR receipt scanning, gen-AI expense report creation, travel booking integration, and spend analytics.

- Strong payment capabilities: Streamlines payments with direct payments, international payment support, and the ability to link multiple banks to a subsidiary.

- 24/7 fraud and risk mitigation: Flags potential fraud with a dedicated fraud investigation team that operates around the clock.

Airbase G2 rating: 4.8/5

Airbase pricing.

Airbase offers three packages: Standard, Premium, and Enterprise. All the packages include key platform features with optional add-ons available for travel, POs, and approval workflows. Users can also opt for individual modules instead of the whole platform.

Customers and best suited for:

- Company size: Mid-market to large enterprises (with 50 to 10,000 employees).

- Solution needs: Businesses looking for a scalable solution for Guided Procurement, AP Automation, Expense Management, and/or Corporate Cards or those seeking an all-in-one procure, pay, close solution by adopting the full suite.

2. Mesh Payments.

Mesh Payments is a good choice for businesses looking for Concur competitors with free plans. Apart from travel management, Mesh offers AP automation and spend management solutions. Unlike Concur, Mesh Payments also has an exclusive solution for SaaS subscription management.

Expenses and reimbursements can be managed under one budget

Best features.

- Travel management: Provides multi-agency support, booking tools, and built-in policy enforcement to control spend.

- Expense management: Categorizes expenses with automatic matching of receipts, approval workflows, virtual cards, and quick reconciliation of transactions.

- Payment insights: Offers real-time data on each payment including SaaS subscriptions, travel expenses, and in-person purchases.

- Multi-subsidiary workflows: Enables tracking and management of receipts, expense categorization, and reconciliation across subsidiaries.

Mesh Payments G2 rating: 4.6/5

Mesh Payments pricing.

Mesh Payments’ packages are available across three categories — Pro, Premium, and Enterprise. The Pro plan is free while the Premium plan is priced at $10 per user per month. The pricing for the Enterprise plan is customized based on the business’s specific needs.

Customers and best suited for:

- Company size: Small, medium, and large businesses.

- Solution needs: Businesses with international entities looking for features such as virtual cards, SaaS subscriptions, travel, and global spend management.

3. Alaan.

Alaan is an expense management platform designed for businesses operating in the Middle East. Apart from streamlining receipt management and spend controls, it offers corporate cards, AP automation, and AI-powered analytics.

A unified dashboard for expense policies and approvals

Best features.

- Expense management: Automates expense reports from scanned receipts while enabling admins to set custom approval policies, spend limits, and vendor locks.

- AP automation: Integrates with major accounting software. All your expenses are synced with your books — details, receipts, and all the information you need to keep your books up to date.

- Tax compliance: Assists with tax code management by enabling users to map tax codes to specific transactions.

- Corporate cards: Makes it easy to create physical and virtual cards with spend controls while offering cash back on domestic and international transactions.

- Analytics: Leverages the power of AI to offer insights on spend while enabling fraud detection.

Alaan G2 rating: 4.7/5

Alaan pricing.

Alaan offers four packages — Starter, Pro, Premium, and Enterprise — to accommodate businesses of varying sizes and requirements.

Customers and best suited for:

- Company size: Small, medium, and large businesses.

- Solution needs: Businesses in the Middle East that are looking for simplified spend management and AP automation features.

4. Pleo.

Based in Europe, Pleo is a spend management solution that caters to expense management and bookkeeping needs of businesses across industries. By offering a free plan with expense tracking, accounting integrations, and corporate cards, Pleo emerges as one of the best alternatives to Concur for micro companies.

Real-time view of all expenses

Best features.

- Expense management: Enables management of expenses, including mileage, subscriptions, and cards while streamlining employee reimbursements.

- Invoice automation: Streamlines invoice capturing and allows admins to review and set payment schedules from a unified dashboard.

- Bookkeeping: Integrates with 30 accounting software to streamline bookkeeping.

- Corporate cards: Allows admins to set controls on corporate cards, and review and manage spends from one platform.

- Spend analytics: Offers a central dashboard with detailed spend insights.

Pleo G2 rating: 4.7/5

Pleo pricing.

Pleo offers three pricing plans — Starter, Essential, and Advanced. The Starter plan is free while the Essential plan costs $57 (£45)* per month ($49.3 per month if billed yearly). The Advanced plan is priced at $125 (£99) per month ($112.6 per month if billed yearly).

*Exchange rate: £1= $1.27

Customers and best suited for:

- Company size: Startups, small businesses, and enterprises.

- Solution needs: Companies seeking simple expense and bookkeeping automation.

5. Paycom.

While Paycom is primarily recognized as an HR and payroll software, we have featured it in our list of Concur alternatives due to its expense management features. Paycom’s expense management solutions offer efficient tracking, approval, and reimbursement of employee expenses.

Scanned receipts are automatically parsed with AI technology

Best features.

- Automated receipt parsing: Facilitates expense report creation by automatically parsing uploaded receipts using AI technology.

- Credit card integration: Links employees to credit card numbers to expedite the building of expense reports.

- Expense allocation: Syncs with GL and automatically allocates expenses.

- Custom approval flow: Offers customizable approval chains for expense approvals.

- Mileage tracker: Allows employees to track and submit mileage through the mobile app.

- Reimbursement flow: Automatically routes approved reimbursements through the expense tracking software flow into payroll.

- Custom reports: Provides on-demand reports on expense transactions.

Paycom G2 rating: 4.2/5

Paycom pricing.

Pricing information is not available on Paycom’s website.

Customers and best suited for:

- Company size: Small, medium, and large businesses.

- Solution needs: Companies that are looking for an integrated HR, payroll, and expense management solution.

6. Emburse Certify.

Emburse Certify Expense is one of the suitable Concur alternatives for small businesses and startups. The platform has an intuitive interface that streamlines expense report creation and management.

Dashboard with real-time data on expenses

Best features.

- Expense management: Enables issuing of physical and virtual cards with custom spend limits and automates expense reports with ReportExecutive on a set schedule.

- Receipt capturing: Leverages Emburse Receipt Technology to extract data from receipts that can be added via email, mobile app, and fax or imported from partner vendor sites.

- Audit trail: Tags and codes transactions automatically in Emburse Certify Expense before syncing to GL.

- Reports and analytics: Offers 40 standard reports, a custom report builder, and actionable dashboards for analytics.

- Global payment support: Converts 140 currencies in real time based on the expense date.

Emburse Certify Expense G2 rating: 4.3/5

Emburse Certify Expense pricing.

Emburse Certify Expense offers two types of plans based on the number of employees. Certify Now, designed for businesses with 1-25 employees, is priced at $12 per user/month, while the Professional plan offers flexible pricing options for small and medium businesses.

Customers and best suited for:

- Company size: Small to medium businesses.

- Solution needs: Businesses looking for an easy-to-use expense management software in addition to travel booking and payment solutions.

7. Fyle.

Fyle offers a comprehensive suite of features designed to streamline expense management for businesses. It is one of the top Concur alternatives for businesses looking for multiple ways to submit and approve expenses, including via text messages, email, Slack, and Microsoft Teams.

Multiple ways to submit and approve expense reports

Best features.

- Receipt submission: Offers multiple ways to submit expenses via text messages, mobile app, Slack, or email.

- AI-powered coding: Automates expense coding with AI technology.

- Customizable expense form: Helps capture all relevant expense data based on projects, departments, and cost centers with a customizable expense form.

- Centralized dashboard: Provides insights on expenses and their status, card spend information, and payment status.

- Multi-organization approvals: Simplifies approval processes for users managing teams across multiple entities or subsidiaries.

- Expense approvals: Automates sequential, parallel, project-led, or any other approval workflow, and allows approvals from Slack and Microsoft Teams.

Fyle G2 rating: 4.2/5

Fyle pricing.

There are three pricing tiers that cater to varying business needs. The Standard plan is priced at $6.99 per user/month and the Business plan costs $11.99 per user/month. The Enterprise plan offers custom pricing for multi-country enterprises.

Customers and best suited for:

- Company size: Small to medium businesses and enterprises.

- Solution needs: Accounting firms and multinational companies looking for streamlined expense management across subsidiaries.

8. Center.

Next up in our list of Concur alternatives is Center, a platform with similar travel and expense management solutions tailored for small and mid-market businesses. Apart from custom approval workflows and easy receipt capturing, Center fast-tracks the reconciliation of expenses.

Real-time visibility into spend

Best features.

- Expense management: Offers flexible spend controls and approval workflows while helping monitor employee spend in real time.

- Compliance and reconciliation: Identifies out-of-policy spend and imports expenses seamlessly into accounting software for reconciliation.

- Spend analytics: Provides detailed analytics and top-level overview of spends.

- Travel booking tools: Streamlines expense submission by auto-populating expense fields, offers self-service tools, and customizable tracking of travel spend by job or project.

- Integrated purchase data: Allows issuing of cards with spend controls and helps integrate purchase data into Center Expense.

Center G2 rating: 4.6/5

Center pricing.

Center does not charge a license fee or platform fee. However, transaction fees apply every time the CenterCard is used or a trip is booked.

Customers and best suited for:

- Company size: Small and mid-market companies.

- Solution needs: Companies that are looking for affordable travel and expense management solutions.

9. Navan.

Navan is a Concur alternative with a user-friendly interface and an simple booking experience. It’s a popular choice for smaller businesses.

Customizable spend policy and controls

Best features.

- Automated expense reports: Syncs the details automatically once employees add a corporate card or upload receipts.

- Customizable spend controls: Allows setting of spend controls and flags out-of-policy spends. Quick reconciliation and reimbursements: Categorizes and reconciles transactions and facilitates reimbursement in multiple currencies.

- Intelligent travel booking solution: Supports the creation of travel spend policies and simplifies booking of individual and group travel in addition to offering consulting services for travel management.

- Rich travel data insights: Offers real-time visibility into travel bookings and expenses on a customizable dashboard.

Navan ratings.4.7/5

Navan pricing.

Navan does not charge a platform fee and users can set up an account for free.

Customers and best suited for:

- Company size: Small to medium-sized businesses and enterprises.

- Solution needs: Corporates seeking a comprehensive travel booking solution in addition to simplified expense management.

10 Zoho Expense.

Zoho Expense offers a range of tools to help businesses manage their travel and other expenses. Like the other alternatives to Concur listed here, Zoho Expense has autoscan capabilities that simplify receipt management in addition to mileage tracking and custom approval workflows.

Custom purchase approval workflows

Best features.

- Travel booking: Makes it easy to book and manage business trips while enabling adherence to company policies using a self-booking tool.

- Receipt scanning and import: Reads receipts in 14 languages using the auto-scan feature while allowing receipts to be imported from various cloud storage platforms.

- Mileage tracking: Automatically records mileage through GPS for accurate tracking.

- Spend insights: Offers insights into corporate card usage with a comprehensive dashboard.

- Custom approval flows: Enables creation of multi-level approval flows for purchase requests to streamline the approval process.

Zoho Expense Ratings 4.5/5

Zoho expense pricing.

There are four packages available — Free, Standard, Premium, and Custom. The Standard plan costs $4 per user/month when billed annually while the Premium plan is priced at $7 per user/month.

Customers and best suited for:

- Company size: Self-employed individuals, small businesses, and enterprises.

- Solution needs: Companies and individuals looking for affordable travel and expense management solutions.

Airbase vs Concur.

Let’s expand our Airbase vs Concur comparison by delving into the specifics of their offered features.

What does Airbase do?

Airbase has emerged as one of the top alternatives to Concur for businesses seeking a holistic P2P and spend management solution. The platform optimizes the entire spectrum of intake, be it streamlined purchase requests, approval workflows, PO matching, vendor management, direct payments, or seamless syncing of transactions into the GL.

In the category of spend management, Airbase offers advanced features, including OCR, generative AI and ML-based receipt scanning, travel booking integration, mileage calculation, and in-depth spend analytics. Airbase is also one of the leading Concur alternatives for businesses looking for a flexible corporate card program — a feature that is missing in Concur.

Airbase solutions.

Guided Procurement.

Leveraging advanced automation, custom approval workflows, and vendor management tools, the Guided Procurement module boosts purchasing efficiency and ensures compliance with company policies. Purchasers receive intuitive guidance at every step of the purchase process while centralized procurement enhances visibility and control over the purchase process. Airbase integrates with Jira, Ironclad, DocuSign, and more, to enable stakeholders to approve requests from their existing tech stack.

Accounts Payable Automation.

The AP Automation module automatically captures invoices from emails, mobile app, and vendor portals across all subsidiaries. Airbase’s automated purchase order system generates a transaction file when a PO request is made, consolidating all related documents within the file.

Invoices are routed to relevant approvers based on multiple parameters while POs are matched to ensure their accuracy. Payment to vendors can be made directly from the platform and Airbase offers comprehensive international payment support across 200 countries in 145+ currencies. Deep integrations with ERPs ensure smooth syncing of transactions which helps accelerate month-end closing.

Expense Management.

The sophisticated Expense Management module enables businesses to effortlessly manage their expenses while giving complete visibility over spend. AI-driven OCR technology instantly creates expense reports from scanned receipts while generative AI fills expense memo fields and assigns a purpose for the expense based on past patterns.

Mileage tracking and an integration with TravelPerk ensure seamless incorporation of all trip booking details into the Expense Management module. Advanced workflows expedite approvals, with reimbursements automatically processed.

Corporate Cards.

Airbase offers a comprehensive Corporate Card program with virtual, physical, and partner card integrations for AMEX and SVB. Transactions seamlessly sync to the GL thanks to Airbase’s integration with 70+ ERPs including Oracle Corpay, Emburse Certified Expense, and QuickBooks Online.

What does Concur do?

SAP Concur offers an integrated T&E solution that facilitates travel booking, approval, and expense reporting. It later added the AP automation module, which offers the expected functionalities of custom workflows, automated invoice capturing, and ERP synchronization. A stand-out feature is the Intelligent Audit service that combines the power of human oversight with AI to verify the accuracy of receipts while ensuring regulatory and tax compliance.

Travel management.

Concur Travel offers a suite of travel management features to streamline business trip management. Travelers can book compliant trips directly via a mobile app, select flights and hotels from the partner network, and pay for the trip using their corporate cards. Companies can design approval workflows for their unique trip, and employees have the option of requesting cash advances for trips. Users can link their Concur account to TripIt to improve their experience.

Expense.

Concur streamlines expense management with the help of multiple apps. Concur Expense makes it easy for employees to submit their receipts and create expense reports, and managers can approve the spend via a mobile app. The Concur Drive mobile app captures mileage automatically, facilitating effortless expense reporting. Custom trip approval workflows can be tailored to your organization’s needs, including the option to request cash advances.

Invoice.

Although not a comprehensive AP automation solution, Concur’s Invoice module makes the process less tedious. By combining AI, OCR, and machine learning, Invoice extracts invoice details submitted through email, fax, or mobile and routes the invoices through the desired approval workflows. Users can create POs within the platform or import from other sources while Concur matches them with invoices and item receipts through custom integrations with ERP. Concur also offers a Purchase Request module add-on to enable managers to reject or approve purchase requests before spend can occur.

Payment solutions.

Concur does not offer a direct payment solution or virtual cards but helps users manage payments through third-party app integrations. It does have a Payment Manager feature that helps manage bulk payments by creating payment batches.

In summary.

Both Airbase and Concur support travel spending with integrations for booking and paying for travel. Airbase does this via its partner, TravelPerk, which has the largest travel inventory of any vendor. However, for businesses seeking end-to-end AP automation or a full P2P solution, Airbase provides much more functionality.

In addition to being one of the most affordable and easy-to-implement Concur alternatives, Airbase is also the only solution that automates the entire lifecycle of a purchase, from procurement to payment to closure. With its TravelPerk integration, Airbase makes it easy to manage bookings and travel-related expenses.

Unlike Concur, which offers limited direct HRIS integrations, Airbase seamlessly synchronizes employee information from 29 diverse HRIS solutions, including Okta, Rippling, BambooHR, Gusto, and Workday, to ensure employee data stays current, secure, and accurate.

See how Airbase represents the next generation of P2P solutions — book a demo with us!

Jira

Jira  Ironclad

Ironclad  Asana

Asana