Exciting advances in generative artificial intelligence (AI) and machine learning (ML) are changing how organizations manage financial processes.

With transformative powers to drive efficiency, accuracy, and inform strategic decision-making, the use of AI and ML is rising at a truly remarkable pace.

What does this mean for accountants’ careers? How can finance teams best harness the power of AI? And what about security concerns?

Let’s take a look at the current state of AI in accounting and finance and what the future holds.

The rapidly increasing role of AI in accounting and finance.

Organizations that don’t embrace new developments in AI run the risk of being left behind. One survey found that 83% of accountants have experienced AI in their workday.

But we are still in the early stages, with unprecedented growth expected. The estimated market size for AI in accounting is $1.56 billion in 2024, with a projected increase to $6.62 billion by 2029, according to data from Mordor Intelligence.

A big factor behind the accelerated growth is advances in large language models and their support of generative AI. This has introduced unprecedented scale and pre-training on diverse datasets.

How AI and ML work.

Machine learning (ML) is a subset of artificial intelligence (AI) that involves the development of algorithms that help systems learn and make predictions or decisions without being explicitly programmed.

In simple terms, a model is trained on a dataset, using statistical techniques to identify patterns, relationships, and trends. Over time, ML models adapt and improve their performance as they encounter more data, making them powerful tools for tasks such as image recognition, natural language processing, and predictive analytics.

Generative AI, on the other hand, is a subset of ML that focuses on creating new content rather than making predictions based on existing data. Generative models are trained on datasets to generate new data that resembles the patterns of the original input. Through iterative training, the generator improves its ability to create realistic data.

In finance, ML and generative AI enable the development of predictive models for market intelligence and risk assessment, while also creating synthetic data for scenario analysis and stress testing.

How AI is used in accounting today.

Traditionally, the accounting industry has centered around meticulous number-crunching, complex calculations, and compliance-driven tasks.

AI is ushering in a new era where machines take on the repetitive, rule-based functions, allowing accountants to focus on higher-value, strategic activities.

From automated data entry to real-time financial analysis, incorporating AI into accounting software streamlines financial processes and reduces the risk of human error. Here are some of the major functions incorporating AI.

Efficient invoice processing and reconciliation.

By some estimates, incorporating accounting AI into e-invoicing will save up to $28 billion in the next 10 years.

If that number is too big to wrap your head around, consider how many hours an AP team spends reconciling transactions with invoices.

AI technologies, particularly optical character recognition (OCR) and machine learning algorithms, play a pivotal role in streamlining invoice processing.

OCR extracts relevant information from invoices, including invoice numbers, dates, line items, and amounts. AI automatically assigns transactions a category based on past behavior.

Transactions are coded, tagged, and recorded in the GL without manual effort. This eliminates the need for manual data entry, reducing the likelihood of human errors and accelerating the overall processing time.

Advanced platforms can take this further for a touchless AP experience. For example, Airbase users can choose to have invoice details coded at the line level, by vendor, or summarize the bill into one line item after the invoice is scanned. Generative AI and MIL automatically populate the description and category so the accuracy improves with every transaction.

In the reconciliation process, AI accounting software powers the process of matching financial transactions with corresponding invoices. Through pattern recognition and data analysis, AI systems can swiftly identify discrepancies and exceptions, flagging them for further review by human accountants.

This not only expedites the reconciliation process but also enhances accuracy by minimizing the risk of oversight.

In essence, AI transforms invoice processing and reconciliation from time-consuming manual tasks to efficient, accurate, and automated accounting processes that contribute to overall financial transparency and integrity.

Touchless expense reporting.

Nobody likes filling out expense reports. Now, technology can take over that often-procrastinated task.

With Airbase, you simply take a photo of a receipt in the mobile app or submit it through a dedicated receipt inbox. Airbase takes it from there, automatically populating expense request details using the latest in OCR technology. Built-in ML extracts the relevant information, including GL category, date, amount, and vendor, and generative AI fills in the purpose based on past patterns.

This touchless expense reporting unlocks proven time savings — our analysis shows not having to complete tedious expense reports saves employees an average of 46 hours per year!

Take a tour of Airbase.

Explore Airbase with a self-guided tour.

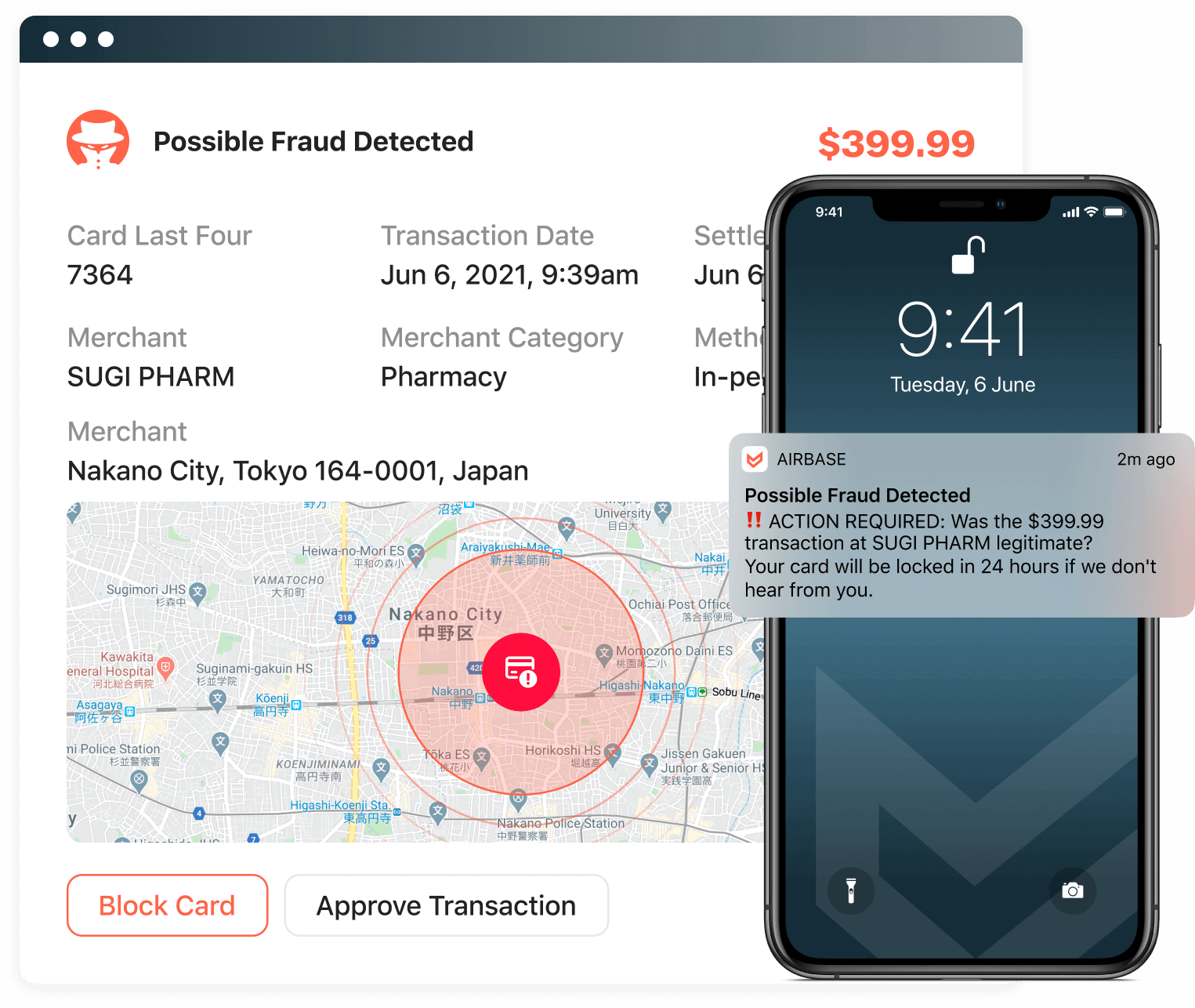

Fraud detection.

AI can analyze vast amounts of data far faster than any human.

The ability to analyze financial data from diverse sources simultaneously, including transaction history, user behavior, and external data feeds, empowers accounting professionals to uncover subtle signs of fraudulent activity that may escape human eyes. Suspicious transactions can be instantly flagged for further investigation

AI is trained on historical fraud cases, so its detection skills are continuously evolving.

Budgeting and forecasting.

AI in FP&A empowers data-driven decisions and helps organizations navigate complex financial forecasting with agility and precision.

By analyzing large datasets, AI can provide insights into market conditions, competitive landscapes, and other factors that affect planning and strategy.

Machine learning algorithms enable more accurate forecasting by analyzing historical data and identifying patterns and variables. This predictive capability supports accurate scenario planning and risk assessment.

AI-driven automation also takes over manual, routine accounting tasks like data entry and report generation so the FP&A team can focus on strategic analysis.

Document intelligence.

AI can instantly identify key information from order forms and SOC documents to save time and improve accuracy. When built into intake workflows, AI extracts crucial data such as payment terms, auto-renewals, and pricing details. In Airbase, generative AI prefills all of these purchasing details and GL links to reduce manual data entry.

AI can also scan SOC documents to detect and highlight potential exceptions and tested controls so approvers can efficiently review and manage related purchase requests within existing workflows.

Back-office functions.

Back-office functions are the administrative and support tasks critical to a company’s operations, including data entry, processing, payroll, and compliance activities. AI helps automate these repetitive tasks to save time.

But AI’s impact on back-office functions extends beyond mere task automation; it introduces a paradigm shift by leveraging continuous learning from historical data.

These systems evolve to handle intricate tasks that conventionally necessitate human intervention. AI then minimizes the inherent risk of errors in manual work, elevating the overall accuracy and efficiency of back-office business processes everywhere.

By harnessing AI’s ability to learn from experience, organizations benefit from streamlined operations, reduced reliance on repetitive manual efforts, and an enhanced ability to navigate complex and dynamic business environments.

Automating bookkeeping tasks.

Many bookkeeping and accounting tasks can be taken over by AI, including:

- Categorizing transactions.

- Reconciling transactions.

- Data entry, including extracting info from receipts and invoices.

- Identifying errors and discrepancies in financial data.

It’s often said that AI will elevate the accounting profession by freeing up more time to focus on value-added activities that are more rewarding. For that reason, job prospects aren’t expected to decline for accountants and auditors.

Bookkeepers, on the other hand, do face declining job prospects. Bookkeepers can protect their career path by focusing on developing soft skills such as critical thinking, problem-solving, and effective communication will further distinguish bookkeepers in roles that require a human touch, such as client interactions and strategic financial advisory services.

Proactively learning to integrate AI tools into their skill set can only enhance job security further.

How are the big accounting firms using AI?

AI-powered auditing tools.

AI is increasingly revolutionizing auditing tools, enhancing efficiency and accuracy in financial scrutiny.

Machine learning algorithms, exemplified by systems like EY’s Helix GLAD, empower auditors to detect anomalies and potential fraud in vast datasets.

In addition to quickly analyzing vast amounts of data, AI can provide a consistent and objective approach.

Account-specific insights.

Because AI facilitates predictive analytics, accounting firms can leverage AI to anticipate future trends and make proactive recommendations for their clients.

The ability to extract account-specific insights not only improves the accuracy and efficiency of financial assessments, it also empowers accountants to offer more personalized and value-driven services.

Predictive analytics.

AI-driven predictive analytics help accountants identify potential risks, opportunities, and market fluctuations so they can adjust their strategies.

One example is cashflow forecasting. Accounting AI models can provide accurate predictions of future cash inflows and outflows, which helps anticipate potential liquidity challenges, optimize working capital, and make informed decisions about investments or cost-cutting measures.

Efficient client data analysis.

Accounting firms harness AI in accounting software for efficient client data analysis.

For example, firms can utilize AI in tax compliance, where algorithms can analyze vast datasets to identify tax implications, optimize deductions, and ensure tax compliance with ever-evolving regulations.

In advisory services, AI assists in market research, risk assessment, and financial forecasting, providing clients with strategic insights for better decision-making.

Benefits of using AI in accounting and finance.

It’s a brave new world for finance and accounting professionals. As accounting AI advances at a rapid pace, here are some of the advantages.

Automation of routine tasks.

AI in accounting software automates mundane and repetitive tasks such as data entry, invoice processing, and transaction categorization, freeing up time for accountants to focus on more strategic activities.

Enhanced accuracy.

Machine learning algorithms improve the accuracy of financial analysis by reducing the risk of human errors associated with manual data entry and calculations.

Efficient data processing.

AI can quickly analyze vast amounts of financial data, providing faster insights into trends, anomalies, and potential risks.

Real-time monitoring.

AI technology enables real-time financial transaction monitoring, helping promptly identify and address issues, anomalies, or fraudulent activities.

Improved decision-making.

By providing data-driven insights and predictions, AI accounting software enhances the decision-making process for financial planning, budgeting, and strategic financial management.

Cost savings.

Automation through AI leads to cost savings for accounting firms and businesses by reducing the need for manual labor and minimizing the risk of financial errors.

Adaptive learning.

Machine learning models can continuously learn and adapt to evolving financial patterns, ensuring that the accounting systems remain up to date and effective.

Enhanced fraud detection.

AI technology helps in the early detection of fraudulent activities by analyzing patterns, anomalies, and deviations in financial transactions.

Streamlined compliance.

AI accounting software assists in navigating complex regulatory landscapes by automating compliance checks and ensuring that your business’s financial health, financial statements, and records adhere to the latest regulations.

Increased productivity.

With the automation of routine tasks, accountants can focus on high-value activities, leading to increased productivity and improved client services.

Challenges associated with adopting AI in accounting and finance.

Despite the many advantages, incorporating AI in accounting is not without challenges.

One significant hurdle is the resistance often encountered within traditional accounting practices. Accountants may question the reliability of AI accounting software, particularly in areas requiring nuanced judgment or interpretation.

Another challenge is the need for significant investments in technology infrastructure and talent.

Implementing accounting AI systems requires a robust technological framework, including high-performance computing, data storage, and cybersecurity measures.

Additionally, organizations need skilled personnel who can develop, deploy, and maintain AI solutions. The shortage of AI talent in the job market further exacerbates this challenge.

The integration of AI into existing accounting processes also demands careful consideration of ethical and regulatory implications, addressing concerns related to data privacy, security, and potential biases in AI algorithms.

The use of sensitive financial data raises questions about how this information is handled, stored, and protected.

Organizations must implement robust data privacy measures to safeguard against potential breaches, ensuring compliance with stringent data protection regulations and fostering trust among clients and stakeholders.

Successfully navigating these challenges is crucial for ensuring the effective and responsible adoption of AI in accounting and finance.

Discover AI in accounting.

AI is reshaping the landscape of accounting, offering transformative capabilities that enhance efficiency, accuracy, and strategic decision-making.

In the accounting domain, AI automates routine tasks, such as data entry and invoice processing, reducing the risk of human error and helping accountants focus on more value-driven activities.

Machine learning algorithms analyze vast datasets, providing valuable insights for financial forecasting, risk management, and trend identification.

Notably, AI assists in fraud detection by identifying anomalies and irregularities in financial transactions, enhancing the overall integrity of financial systems.

Skepticism within traditional practices and the need for significant technological investments and skilled personnel are hurdles to overcome.

Privacy concerns surrounding financial operations and the handling of sensitive financial data demand robust measures to ensure compliance with relevant data-protection regulations and maintain client trust.

Successfully navigating these challenges is crucial for realizing the full potential of AI in the accounting industry, as organizations strive to strike a balance between innovation and the ethical, secure, and responsible use of advanced technologies in the financial domain.

Discover Airbase’s automated procure-to-pay platform and see how we leverage artificial intelligence to improve efficiency, accuracy, and control!

Jira Integration – Streamline Your Workflows

Jira Integration – Streamline Your Workflows  Ironclad Integration – Simplify Legal Operations

Ironclad Integration – Simplify Legal Operations  Asana

Asana