AP Automation Software

Make AP Automation a touchless experience

- Eliminate manual data entry and automate invoice processing.

- Increase accuracy and accelerate cycle times with AI-powered OCR.

- Reduce risk with secure global payments in 145+ currencies and 200+ countries.

- Close the books faster with real-time sync to your ERP.

AI-powered touchless AP.

Automate the entire AP lifecycle, including vendor onboarding, invoice processing, bill coding, approvals, payments, ERP syncing, and spend analytics. Touchless AP Automation saves accounting and finance teams hours of manual tasks every week making them more available for strategic work.

The magic of AI.

OCR automatically reads details from an invoice. Choose to have them coded at the line level, by vendor, or summarize the bill into one line item.

Generative AI and machine learning (ML) automatically populate the description and the category so that accuracy improves with every transaction. Save time and move from manual data entry to bill review.

See Airbase in action.

Want a personalized live demo?

Easy vendor onboarding.

Self-service vendor portal and workflows to provide contact, banking, and tax information, and strengthen your global vendor relationships. Vendors have visibility into the payment status of every invoice, and W-9 collection makes 1099 tax reporting a breeze.

Customize a vendor questionnaire to get the information that you need from vendors.

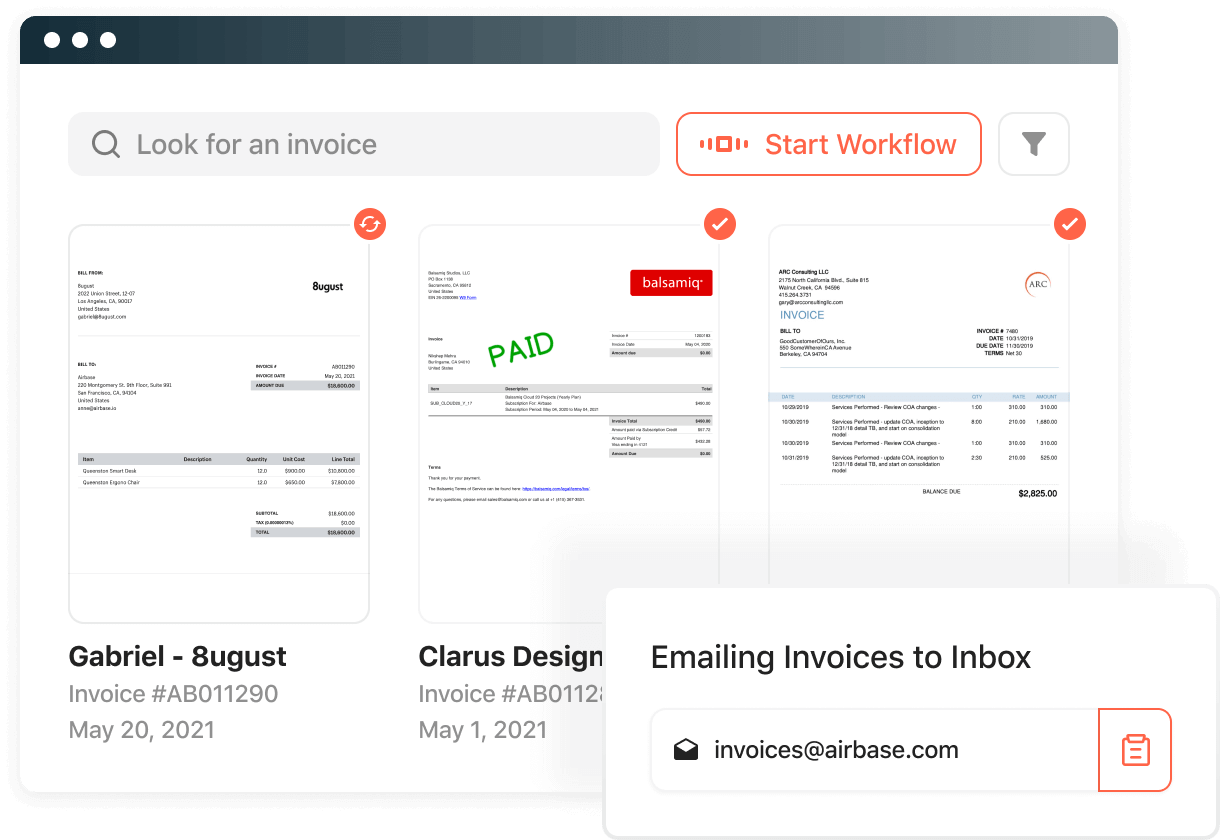

Airbase tells you the story behind every invoice.

Never have questions about an invoice again. Automatically capture and view invoices submitted via email or through the vendor portal across all subsidiaries. Get the full context of an invoice with automatic inclusion of email correspondence that relates to a vendor and a purchase.

Lightning-quick bill creation and approvals.

Scan and populate invoices using our AI-driven OCR technology to make bill creation accurate and easy. Automated approval workflows trigger the appropriate approvers and observers based on multiple parameters, including the vendor, amount, GL category, and more. Team members can review and approve bills via desktop, Slack, mobile, or email at a glance.

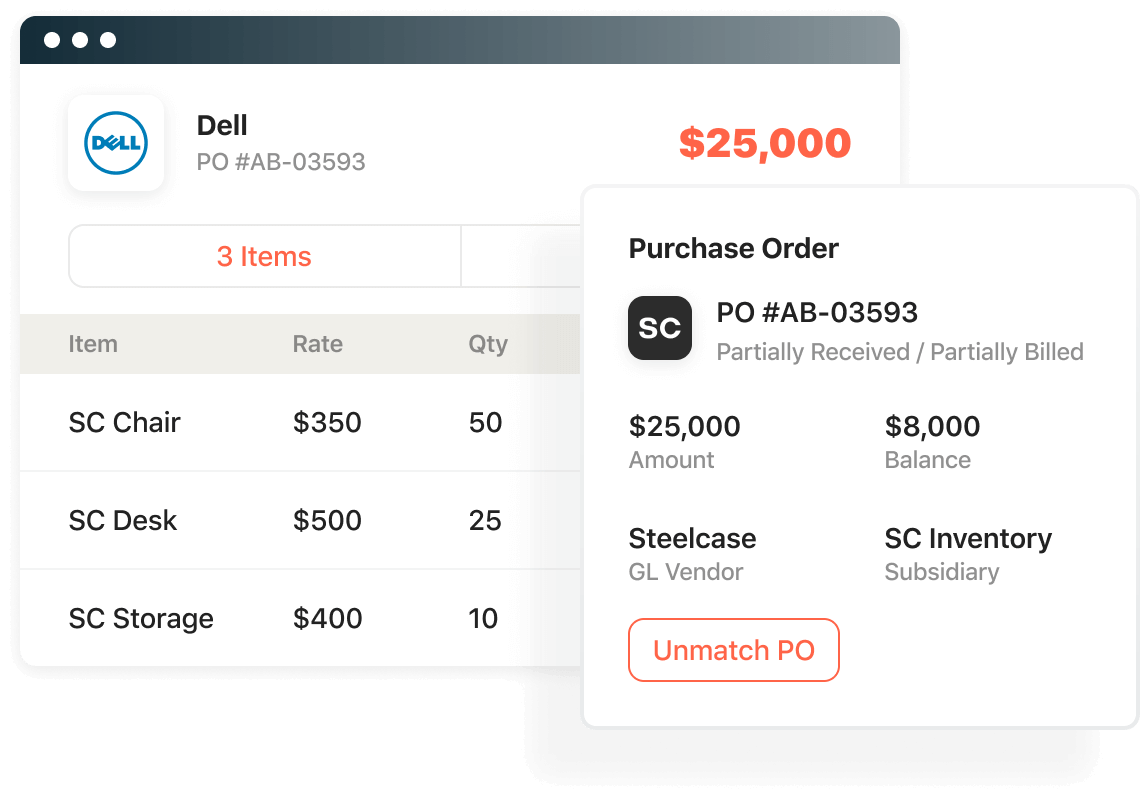

Automated 3-Way PO matching.

Increase efficiency and ensure audit readiness with automatic 3-way match of invoices against your synced NetSuite purchase orders and item receipts. Deep controls ensure your company gets exactly what you pay for to reduce wasted spend and ensure compliance.

EBOOK

Discover how AI-powered automation connects data, people, and systems for a touchless AP experience.

Modern AP Automation Software

A Guided Procurement experience.

Guide employees through the information and documentation they need to collect and the platform will route it directly to stakeholder software. Automate bill creation with AI-powered OCR and intelligence. Then easily make payments and let all approvals, documentation, and transaction details flow through Airbase to your GL.

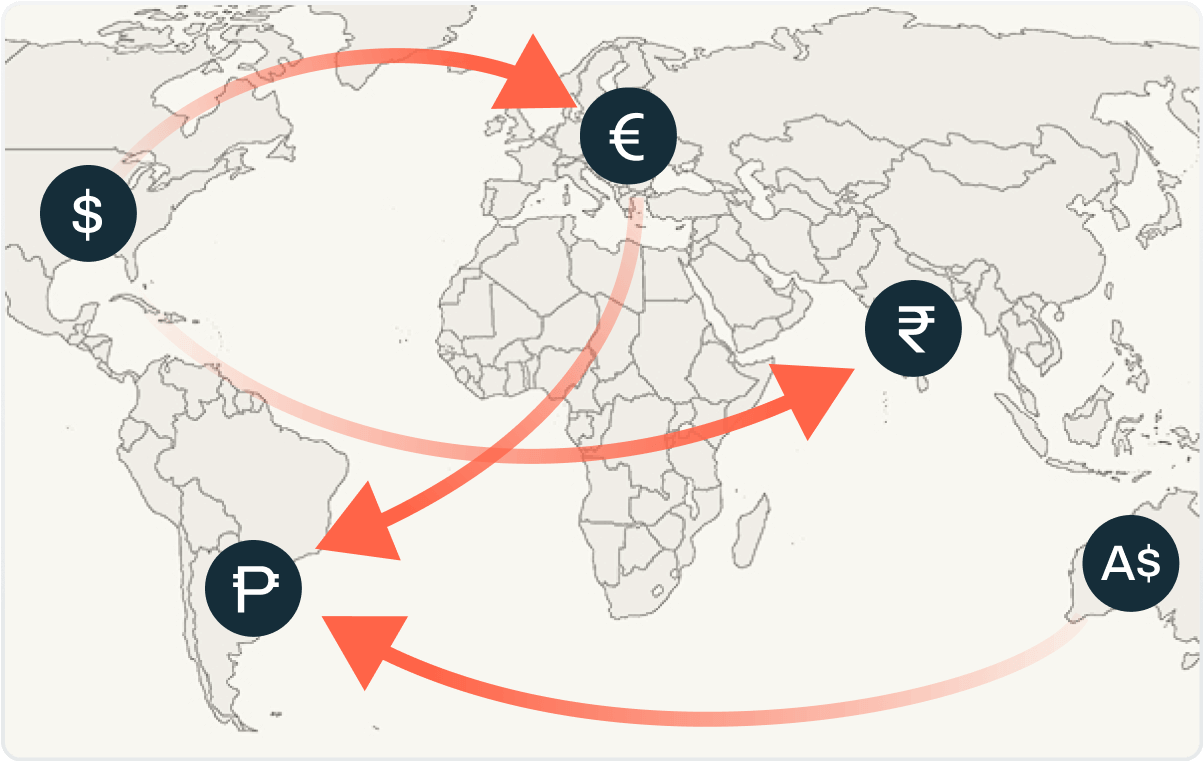

Pay global vendors from any subsidiary.

Pay vendors in 200+ countries supporting 145+ currencies through ACH, check, virtual card, international wires, or vendor credits — all in one AP Automation software platform. Airbase will select the preferred payment vendor for each vendor and note where virtual card payments are accepted to earn cash back. Payment amounts can be split by category.

Automated compliance with real-time sync to the GL.

Ensure compliance, accuracy, and efficiency during an audit or month-end close. With intelligent automation, Airbase will auto-categorize expenses then automatically code, tag, and record transactions into your GL. Banking activity report with individual transactions makes month-end bank reconciliations a snap.

Purchasing made easy for every employee.

When employees across all business groups collaborate on the Airbase platform, communication is clear, compliance is ensured, and requirements for all stakeholders are secured. Modern spend management meets the complex procurement needs of many industry types. Automatically capture and track the data required by each department, enforce compliance, and gain real-time visibility into each step across the procure-to-pay process without the need of clunky antiquated solutions.

AP Comparison Chart

Rippling

Stampli

Bill

Tipalti

Limited

Limited

Limited

Limited

Limited

Limited

145 currencies

50 currencies

150 currencies

96 currencies

120 currencies

Limited

Limited

Limited

Limited

Limited

$$

$$$

$$

$

$$$

Awards

#1 award-winning AP automation solution.

Spend Matters

50 Providers to Watch in Procurement Technology

3rd year in a row

Juniper Research

Best B2B Payments Platform 2024

Platinum Winner

American Business Award

Stevie Awards for the Most Innovative Tech Company of the Year

4th year in a row

Technology Fast 500™ North America

Awarded to Airbase by Deloitte

#45 out of 500

ProcureTech Cup 2024

Winner in Procurement Technologies

#1 out of 64

AP Automation FAQ

What is AP automation?

AP automation is the use of technology to streamline and automate the accounts payable (AP) process.

It does this by digitizing and automating tasks such as invoice processing, data entry, payment approvals, and vendor management.

- Streamlined invoice processing: Automates data entry, approvals, and payments.

- Improved visibility and control: Provides real-time tracking of invoices and payments, for better cash flow management and informed decision-making.

- Cost and time savings: Minimizes processing times and operational costs by eliminating repetitive, labor-intensive tasks. Surfaces opportunities for savings and frees up time to spend on more strategic work.

What are the core problems AP automation solves over manual accounts payable?

- Slow manual data entry: Processing paper invoices by hand wastes time and delays payments.

- Error-prone processes: Typos, duplicates, and miscalculations create financial discrepancies and extra work.

- Approval bottlenecks: Waiting for approvals or misplaced documents slows the payment cycle.

- Limited visibility: Without a 360-degree view, teams are vulnerable to missed deadlines, budget shortfalls, and reconciliation headaches.

- While manual methods have served businesses for decades, automation offers faster, error-free, and more transparent solutions.

How exactly does AP automation work?

AP automation streamlines and automates the AP process for improved efficiency and accuracy.

Processes performed by AP automation include:

Invoice capture.

Scanning invoices and extracting relevant data using the latest OCR technology. In some platforms, vendors can directly submit their invoices, bypassing the need for physical paper transactions.

Invoice matching.

Automating the process of matching an invoice with the corresponding purchase orders and verifying them against pre-defined business rules.

Invoice approval,

Routing invoices for approval based on pre-set, customizable workflows. Best-of-breed AP automation platforms can handle complex approval flows, including concurrent and sequential approvals.

Invoice payment,

Executing electronic payments after approval. Advanced AP automation platforms make it possible to pay by virtual card, vendor credits, ACH, check, or wire transfer.

Transaction booking.

Using pre-set rules, AI, and machine learning to automatically code, tag and record transactions to the GL.

Insight into transactions,

Facilitating comprehensive spend analytics for better visibility and control over the AP process. Spotting bottlenecks in existing processes.

From invoice capture to payment execution and GL booking, automated platforms create a seamless, end-to-end AP experience. Thanks to advanced tools like AI, machine learning, and customizable workflows, businesses gain greater efficiency, visibility, and control over their AP operations — ultimately driving smarter financial decisions and better vendor relationships.

How does AP automation help finance teams scale?

How much does AP automation save?

Is AP automation worth it?

AP automation platforms deliver a positive ROI by streamlining processes, eliminating tedious manual work, reducing costs, and improving overall financial efficiency.

Automation reduces processing costs per invoice, minimizes late payment fees, and helps organizations take advantage of early payment discounts, leading to direct financial savings.

By eliminating manual data entry and paper-based workflows, businesses save time and labor. With the additional time, AP teams can focus on more strategic initiatives.

Beyond cost reduction, AP automation platforms provide substantial indirect ROI through improved accuracy and visibility. Advanced features like AI-driven invoice matching and automatic GL coding reduce errors, avoiding costly financial discrepancies and time spent correcting mistakes.

Real-time spend analytics and insights empower businesses to identify bottlenecks, optimize workflows, and manage cash flow more effectively. Plus, faster approval cycles strengthen vendor relationships by ensuring on-time payments and improving trust.

Ultimately, the ROI of AP automation goes beyond monetary gains. By modernizing and optimizing the accounts payable process, organizations achieve greater agility, control, and scalability — key components in today’s competitive landscape.

What are the main benefits of AP automation software?

- Cost savings: Reduces invoice processing costs, eliminates late payment fees, and surfaces opportunities for early payment discounts.

- Time efficiency: Automates manual tasks like data entry, invoice matching, and approvals, freeing up AP teams for strategic work.

- Improved accuracy: Minimizes errors with AI-driven tools for automatic data capture, coding, and reconciliation.

- Enhanced visibility: Provides real-time insights into spend, enabling better cash flow management and workflow optimization.

- Faster approval cycles: Streamlines approvals with customizable workflows, ensuring on-time payments and stronger vendor relationships.

- Scalability: Supports growing businesses with efficient, automated processes that can handle increased invoice volume.

- Better control: Offers greater oversight and transparency into the AP process, helping identify bottlenecks and improve decision-making.

How do you select the best AP automation software for your needs?

How much does AP software typically cost?

The cost of AP automation software varies depending on factors like the size of your business, the number of invoices processed, and the features offered.

Many vendors offer tiered pricing, where costs increase as you add advanced features like AI-powered invoice matching, analytics, or additional payment options. To ensure value, it’s important to consider the total ROI — savings from reduced labor, fewer errors, early payment discounts, and improved efficiency often more than outweigh the upfront investment.

Is AP automation the same as invoice automation?

How does invoice automation work?

Invoice automation uses the latest technology, including optical character recognition (OCR), artificial intelligence (AI), and machine learning to streamline invoice workflows.

1. Data extraction: OCR and AI extract key details like vendor name, invoice number, and amount owing.

2. Validation: Data is checked against vendor records and flagged for errors or duplicates.

3. Approvals: Invoices are routed through rule-based workflows with notifications to approvers.

4. Matching: Invoices are matched to POs and receipts for accuracy (2-way or 3-way matching).

5. Coding: AI categorizes invoices to GL accounts based on past behavior. AP team members review and adjust if needed, so the platform gets smarter with every transaction.

6. Posting: Approved invoices are recorded in the accounting system.

7. Payments: Payments can be scheduled to optimize cash flow and leverage discounts.

8. Audit trails: All documentation is stored in the transaction record for compliance and transparency.

9. Insights: Analytics provide spend insights and track key metrics.

Learn why Airbase is a Leader in AP Automation.

Jira Integration – Streamline Your Workflows

Jira Integration – Streamline Your Workflows  Ironclad Integration – Simplify Legal Operations

Ironclad Integration – Simplify Legal Operations  Asana

Asana